July Update

In July 2025, global financial markets navigated a complex landscape marked by tariff uncertainties, robust U.S. economic performance, and record-breaking equity indices. While anticipated tariff agreements largely failed to materialize, leading to delays and selective increases in U.S. tariffs, the S&P 500 and Nasdaq soared to all-time highs, driven by stellar tech earnings and optimism surrounding artificial intelligence. The U.S. economy rebounded strongly, growing at a 3% annualized rate, even as inflation ticked higher and the Federal Reserve maintained a cautious stance on interest rates. Meanwhile, geopolitical developments and currency dynamics, including a depreciating Australian dollar and rising oil and gold prices, underscored the intricate interplay of trade, policy, and market sentiment shaping the global economic outlook.

Markets Reach Record Highs

The U.S. stock market achieved remarkable milestones in July, with the S&P 500 surpassing 6,300 and the Nasdaq crossing 21,000, both hitting all-time highs. The Dow Jones Industrial Average also approached its record, closing at 45,010.29 on July 23. Strong second-quarter earnings reports fueled this rally, with over 80% of S&P 500 companies exceeding analyst expectations. Technology stocks led the charge, buoyed by optimism surrounding artificial intelligence (AI) advancements and robust quarterly earnings from major tech firms. Unhedged equities outperformed their hedged counterparts, benefiting from the depreciation of the Australian dollar (AUD) against the U.S. dollar (USD), which enhanced returns for U.S.-based investors.

In contrast, defensive sectors such as healthcare and consumer staples lagged behind, reflecting investor preference for growth-oriented assets amid improving market sentiment. Additionally, the U.S. reached an agreement allowing semiconductor companies to resume shipments of select advanced processors to China, easing some supply chain concerns and boosting tech sector performance.

Earnings Update

Tesla (July 23): Tesla reported a 12% revenue decline to $22.5 billion and a GAAP EPS of $0.33, with vehicle deliveries dropping to approximately 384,000 units. Free cash flow contracted due to heavy investments in AI and robotics, particularly the RoboTaxi pilot. Management emphasized AI initiatives to offset softening auto demand, though the stock faced pressure due to weak core business performance.

Alphabet (July 23): Alphabet delivered strong results, with total revenue up 14% to $96.4 billion, driven by double-digit growth in Search, YouTube, and subscriptions. Google Cloud revenue surged 32% to $13.6 billion, exceeding expectations, while net income rose 19% to $28.2 billion (EPS $2.31). The company raised its 2025 capital expenditure guidance to $85 billion to fuel AI development, boosting investor confidence and contributing to a positive market reaction.

Meta Platforms (July 30): Meta reported a 22% revenue increase to $47.52 billion, with operating income up 38% to $20.44 billion and a widened operating margin of 43%. Net income jumped 36% to $18.34 billion (EPS $7.14). AI-driven advertising tools fueled an 11% rise in ad impressions and a 9% increase in average ad prices, driving a double-digit stock price surge. Meta projected Q3 revenue of $47.5–50.5 billion and committed $60–70 billion to AI infrastructure, including data centers and Nvidia’s Grace Hopper Superchip.

Microsoft (July 30): Microsoft’s fiscal Q4 revenue grew 18% to $76.4 billion, with operating income up 23% to $34.3 billion and net income rising 24% to $27.2 billion (EPS $3.65). Microsoft Cloud revenue reached $46.7 billion, up 27%, with Azure growing 34% year-over-year. The company’s AI and cloud strength drove results above expectations, pushing its market cap briefly above $4 trillion, with shares gaining about 3.5%. Analysts raised price targets, with Evercore ISI increasing to $545 and Wedbush to $600, citing Azure and AI monetization.

Apple (July 31): Apple’s fiscal Q3 revenue rose 10% to $94.0 billion, with EPS up 12% to $1.57. The company set June-quarter records for total revenue, iPhone sales, and Services revenue, with double-digit growth across iPhone, Mac, and Services globally. Despite beating expectations, Apple lagged other Mag7 stocks in AI investment, contributing to a 14% year-to-date stock decline. CEO Tim Cook highlighted a $900 million tariff-related headwind, noting challenges in predicting performance due to U.S.–China trade uncertainties.

Amazon (July 31): Amazon reported a 13% increase in net sales to $167.7 billion, with North America up 11%, International up 16%, and AWS up 17.5% to $30.9 billion. Operating income climbed to $19.2 billion, and net income reached $18.2 billion (EPS $1.68). AI enhancements across Alexa, AWS, and e-commerce drove engagement, though cautious guidance and heavy AI spending tempered investor enthusiasm. Amazon projected Q2 revenues of $159–164 billion, supported by a blockbuster Prime Day event.

The Elephant in the Room: NVDA

Nvidia has reached a staggering $4 trillion market cap, raising the question: is AI priced for perfection? Earnings remain the critical factor. Nvidia’s forward P/E ratio of 33X, while high, is below its recent peak of 43X. Tech earnings, particularly Nvidia’s, continue to drive market performance, with the company solidifying its position as a leading AI pure play. Unlike many private AI companies, which dominate the space but remain inaccessible to public investors, Nvidia offers a rare opportunity. Private companies now stay private longer, with the average age of U.S. IPOs rising from 8 years two decades ago to 14 years today. Most U.S. companies with revenues ≥ $100M are private, limiting public exposure to AI growth.

Nvidia’s Q2 2026 earnings are scheduled for August 27, 2025, after market close. Analysts expect earnings per share (EPS) of approximately $0.65, with revenue projected at $28.5 billion, reflecting year-over-year growth of 80% and 110%, respectively. These figures underscore Nvidia’s critical role in AI infrastructure, particularly in data centers and GPU demand. Expectations are high, and any miss could pressure the stock, given its elevated valuation. However, consistent outperformance in prior quarters has bolstered confidence.

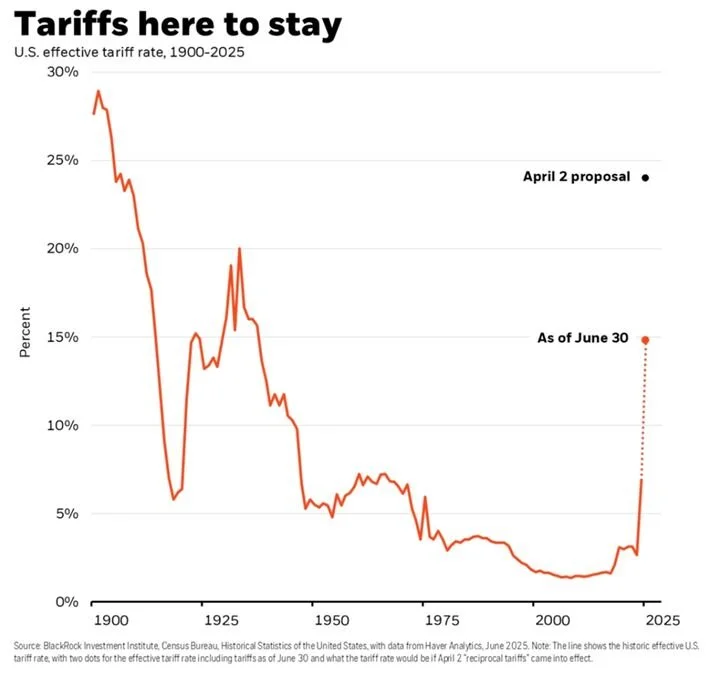

Tariff Developments and Delays

July was anticipated to be a pivotal month for the announcement of new tariff agreements, particularly as deadlines loomed for trade negotiations. However, significant tariff deals failed to materialize, leading to further delays and a patchwork of increased tariffs in the United States. The absence of substantive agreements heightened uncertainty in global markets, though some clarity emerged late in the month. The U.S. finalized tariff deals with several major trading partners just before the August 1 deadline, averting immediate escalations. Notably, a U.S.–EU trade agreement locked in a 15% tariff, preventing a broader trade conflict. Additionally, the U.S. House of Representatives passed President Trump’s flagship tax and spending legislation, dubbed the "Big Beautiful Bill," which is expected to influence trade and fiscal policy moving forward.

U.S. Economic Performance

The U.S. economy demonstrated resilience in the second quarter, growing at an annualized rate of 3%, according to the Bureau of Economic Analysis. This marked a significant rebound from the -0.5% contraction in Q1, which had been driven by a surge in imports amid fears of impending trade tariffs. Inflationary pressures persisted, with the Consumer Price Index (CPI) rising to 2.7% in June, up from 2.5% in May, partly due to the impact of newly implemented tariffs. The Federal Reserve maintained interest rates at 4.25–4.50% during its July meeting, signaling a cautious approach to monetary policy amid rising inflation and robust economic growth.

Australian Dollar Depreciation

The Australian dollar depreciated by 2.3% against the U.S. dollar in July, driven primarily by USD strength rather than inherent AUD weakness. This movement was attributed to persistent U.S. inflationary pressures and diminishing expectations for Federal Reserve rate cuts. At the end of July, Federal Reserve Chair Jerome Powell reinforced this outlook, indicating that the Federal Open Market Committee (FOMC) would remain vigilant, prioritizing inflation control over premature rate reductions.

Rising Risk Assets: Oil and Gold

Oil prices surged by 8.86% in July, with significant gains in the final days of the month. The rally was spurred by the U.S.–EU trade deal and heightened geopolitical tensions, particularly after President Trump imposed a 10-day deadline for additional tariffs and sanctions on Russian oil exports due to the ongoing war in Ukraine. These developments tightened global oil supply expectations, driving prices higher.

Gold prices, meanwhile, rose modestly by 0.9%, maintaining a range of $3,300–$3,400 per ounce. This slower pace compared to earlier in the year reflected cautious investor sentiment, with gold supported by rising U.S. inflation and lingering uncertainties surrounding U.S. tariff policies.

Outlook for the Second Half of 2025

Looking ahead, global economic data is expected to weaken in the second half of 2025, potentially increasing volatility in riskier markets. While cash rates are projected to decline, this may not fully offset the challenges posed by softer economic indicators and ongoing trade uncertainties. Investors should brace for heightened market fluctuations and monitor developments in global trade and monetary policy closely.