Mini Series: Tesla vs. Waymo The 2 Autonomous Driving Titans

20th February, 2026

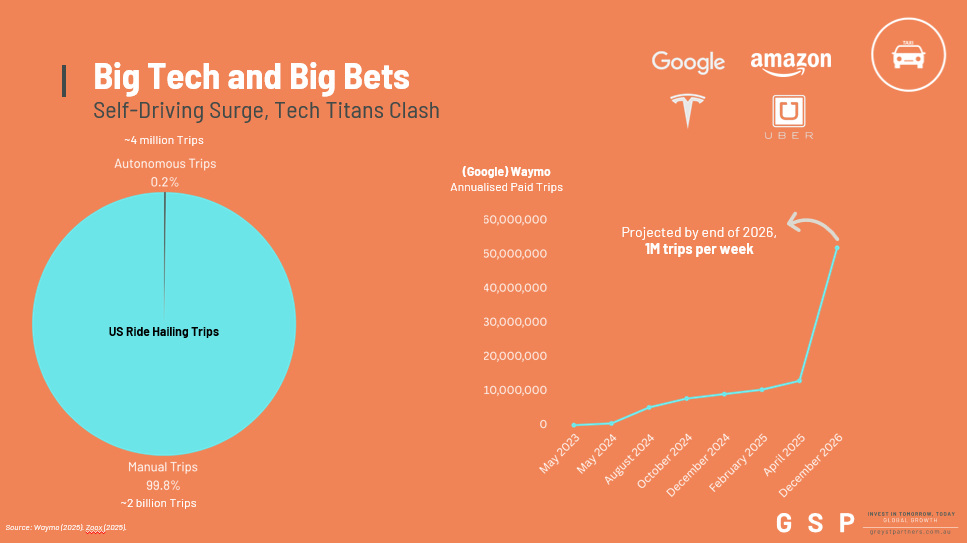

The Current Landscape

In 2024, total ride-sharing trips in the U.S. reached ~2 billion:

Uber/Lyft: 1.8 billion

Traditional taxis: 200 million

Autonomous driving is still tiny, accounting for just 0.21% of trips (~4.2 million):

Waymo: 4 million

Zoox: <50,000

Other providers: <150,000

Despite the small scale, the technology is advancing rapidly, and the stakes are high.

The Key Takeaways

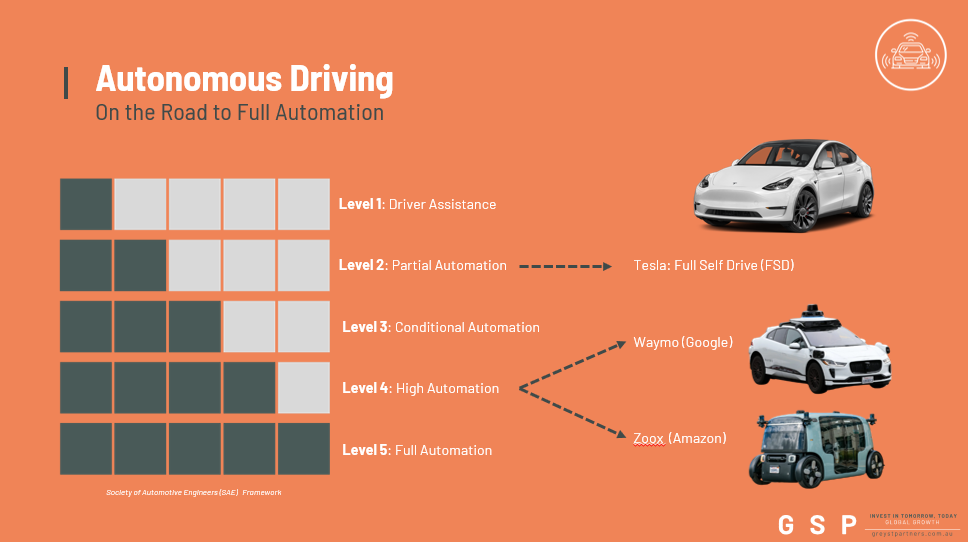

Two paths to autonomy:

Waymo: precision with LiDAR & HD maps.

Tesla: scalable adaptability with vision-based AI.

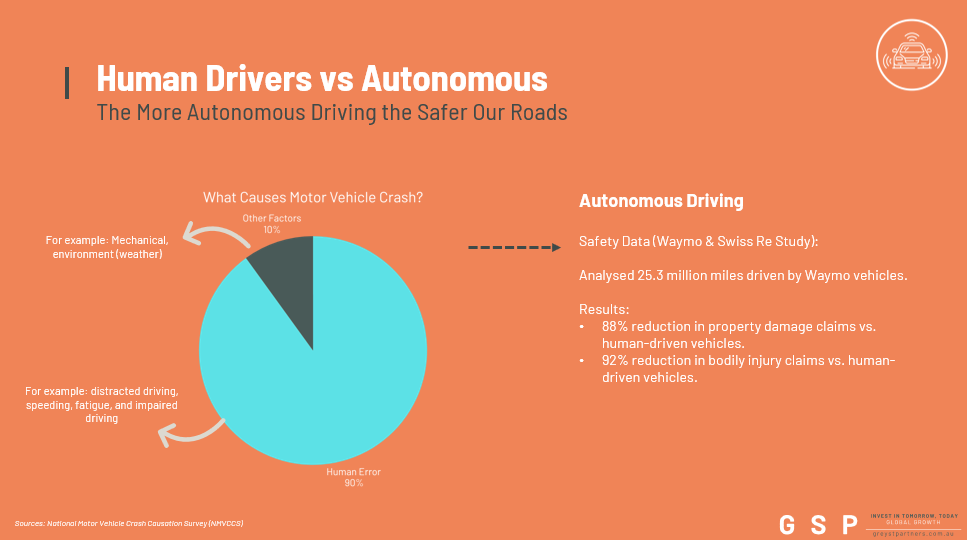

Safety first: Autonomous vehicles already show significant reductions in accidents compared to humans.

Massive revenue potential: The market could exceed $300B by 2035, with profits distributed across tech, auto, and service providers.

The long game is data and scale: Hardware complexity alone won’t win; the fleet that learns and adapts fastest will dominate.

Autonomous driving is not just a technological race—it’s a software, data, and safety arms race, shaping the future of mobility.

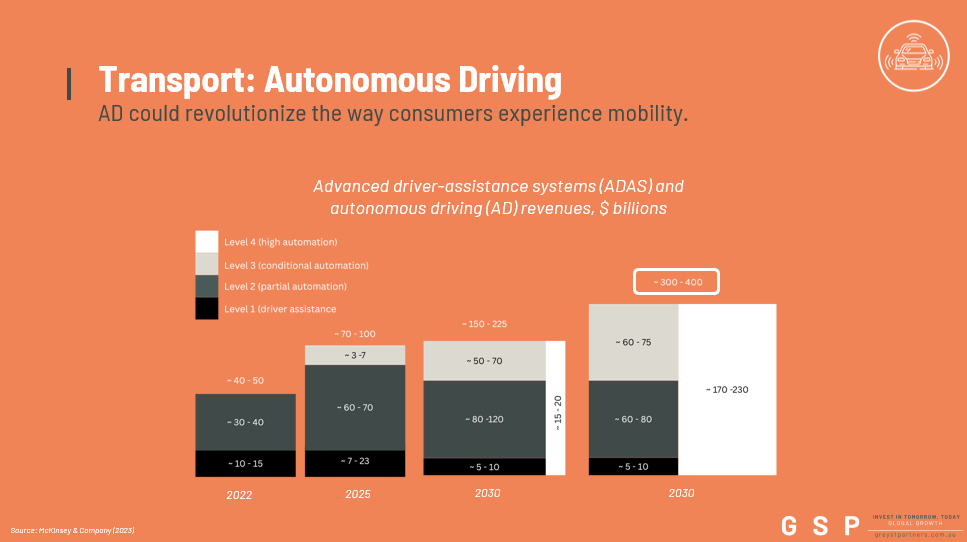

Market Potential

By 2035, autonomous driving could generate $300B–$400B in revenue.

Who’s paying: Consumers and businesses purchasing ADAS-equipped vehicles, infrastructure, software, and related services.

Who’s getting it: Automakers (Tesla, GM), tech providers (NVIDIA, Waymo), software developers, and sensor/hardware suppliers. Maintenance, updates, and data services are also revenue streams.

The opportunity is massive—but the key differentiator will be who can scale safely and efficiently while collecting the data needed to improve performance.

Waymo (Alphabet)

Evolved from the Google Self-Driving Car Project, now a subsidiary of Alphabet.

First to offer fully driverless rides to the public in Phoenix.

Expansion plans include Silicon Valley, Miami, Atlanta, Washington, D.C., and Tokyo.

Trip growth:

2017: ~1,000 trips

2023: 10 million trips (cumulative)

2024: 4 million trips

2025 projection: 13 million trips

April 2025: 250,000 weekly trips

Waymo’s approach is highly precise, relying on LiDAR, radar, and high-definition maps, but it’s costly and complex to scale.

Zoox (Amazon)

Founded in 2014 to develop fully autonomous robotaxis (no steering wheel or pedals).

Acquired by Amazon in 2020 for $1.3 billion.

2023: First public employee rides in Foster City.

2025: <100,000 trips projected, with commercial launch planned for 2026.

Zoox focuses on Level 4 autonomy, operating within geo-fenced areas.

Tesla

Tesla relies on vision-only autonomy, training its systems on billions of real-world miles collected from the fleet.

No LiDAR or HD maps.

Optimizes for adaptability at scale, rather than perfection in controlled environments.

Likely the most disruptive long-term approach, leveraging software, data, and fleet learning.

Safety and Public Perception

Human drivers are responsible for ~90% of U.S. crashes, per the NHTSA.

Waymo & Swiss Re study (25.3 million miles analyzed):

88% reduction in property damage claims

92% reduction in bodily injury claims

Yet public trust remains a challenge—~45% of Americans are uncomfortable sharing roads with driverless cars. Media attention to rare incidents amplifies skepticism.

Waymo (Google): The Perfect Eye

Waymo has built what you might call the perfect eye.

At the core is LiDAR, using lasers to create a detailed 3D model of the world in real time.

Radar measures speed and distance.

High-definition maps provide additional context and precision.

From a technical standpoint, it’s elegant and incredibly precise.

But precision comes at a price:

Expensive to deploy.

Relies heavily on pre-mapped environments.

Scaling to every city in the world is complex.

Waymo performs extremely well in controlled environments, but unexpected changes—like city-level disruptions—can stall multiple vehicles at once.

Tesla: Vision-Only, Data-Driven

Tesla took the opposite approach.

No LiDAR. No HD maps.

Relies entirely on cameras and neural networks.

At first glance, it sounds risky. But over the long term, it may be the more scalable solution.

Why? Vision scales.

Tesla trains on billions of real-world miles across countries, road types, and weather conditions.

Every Tesla on the road collects data.

Every software update improves the entire fleet.

Tesla’s fleet keeps moving even when environments change, proving that adaptability at scale can outweigh perfection in a controlled setup.

The Key Difference

Waymo: Optimizing for perfection in controlled environments.

Tesla: Optimizing for adaptability at global scale.

Autonomy isn’t just a hardware problem—it’s a distribution problem.

The company that solves autonomy using software, data, and scale, rather than relying on hardware complexity, is most likely to win.

Tesla’s vision-only strategy is not just cheaper. It could be the most disruptive bet in autonomous driving.