October Update

October 2025 saw markets climb despite mixed signals from policymakers. The S&P 500 gained as Big Tech led a strong earnings season, six of the Magnificent Seven beat revenue expectations. NVIDIA made history, becoming the first $5 trillion company, while AMD struck a landmark AI deal with OpenAI. Cloud giants posted record growth as AI demand surged. Meanwhile, Jerome Powell cautioned that a December rate cut isn’t guaranteed, tempering rate-cut optimism as yields eased and investors rotated back into growth.

Rate Cut Likely for December, But Not Guaranteed

Jerome Powell stated no guaranteed December rate cut, yet consensus expects one, as he noted tariff-driven inflation is milder than anticipated. September CPI showed 54% of components in deflation, with prices falling amid widening Fed concerns. The ongoing government shutdown, starting October 1 and nearing record length (surpassing 2018–2019's 35 days with minimal market reaction), curbs activity like air traffic, muting inflation.

NVIDIA just made HISTORY - $5T

NVIDIA has just become the first company in history to reach a $5 trillion market cap, a milestone that underscores its transformation from a chipmaker into the architect of the global AI economy. What was once about GPUs is now about building the backbone of artificial intelligence across every major sector. In government and infrastructure, NVIDIA is working with the U.S. Department of Energy to deploy seven AI supercomputers powered by more than 110,000 Blackwell GPUs, while Oracle is collaborating with NVIDIA to build Solstice, the DOE’s largest AI supercomputer to date. In telecommunications, Nokia has committed $1 billion to its 6G AI platform, known as ARC, leveraging NVIDIA’s compute capabilities to power next-generation connectivity. Across enterprise AI, CrowdStrike is using NVIDIA technology to accelerate its AI-driven cybersecurity platform, Palantir is expanding its AI analytics tools, and OpenAI has formed a $100 billion partnership with NVIDIA to scale global AI compute infrastructure. Even in quantum computing, NVIDIA’s NVQLink is connecting 17 quantum developers and 9 U.S. national labs, bridging the gap between classical and quantum compute. Every system NVIDIA builds is now manufactured in America, reinforcing its role as a strategic enabler of national and technological strength. NVIDIA isn’t just selling GPUs anymore, it’s powering governments, enterprises, and telecoms to build the digital infrastructure of the AI century.

Debunking the Bubble (again)

Low P/E ratios, even forward P/Es, do not automatically mean we are bubble-free. Bubbles come in two types: P (price) bubbles and E (earnings) bubbles.

P bubbles, like 1999 and Japan, happen when valuations get out of control.

E bubbles, like 2008, happen when earnings are inflated by excessive risk-taking.

Sometimes both appear together, which is why simple P/E comparisons can mislead. Parts of the market may be in a P bubble, others in an E bubble. E bubbles are harder to spot because earnings can look strong even as risk builds.

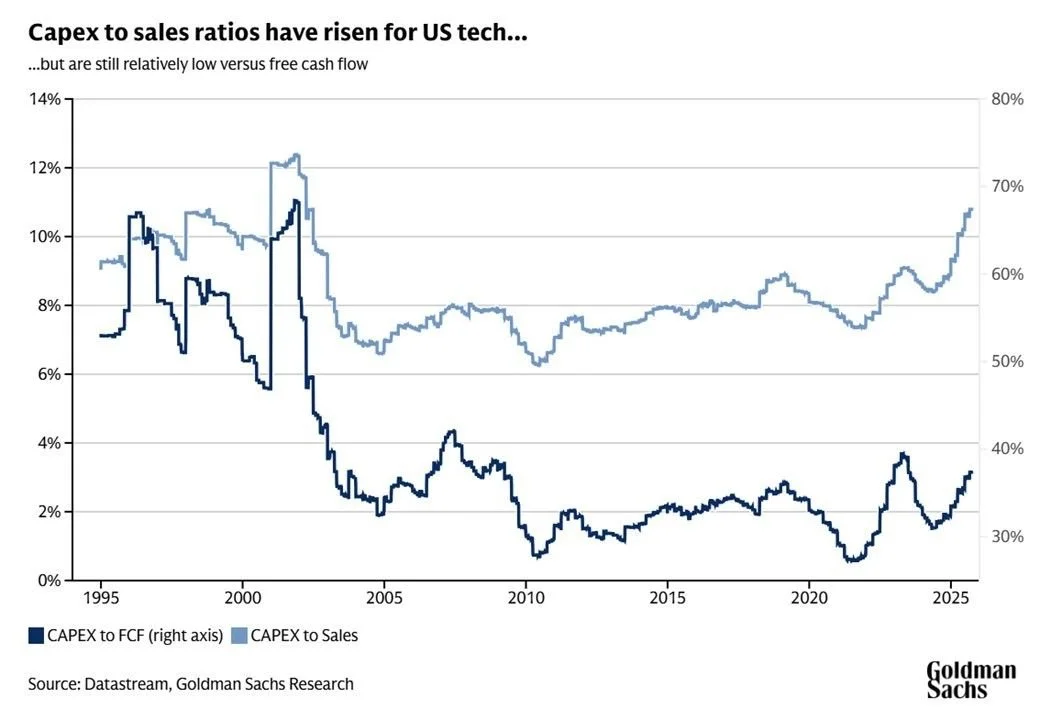

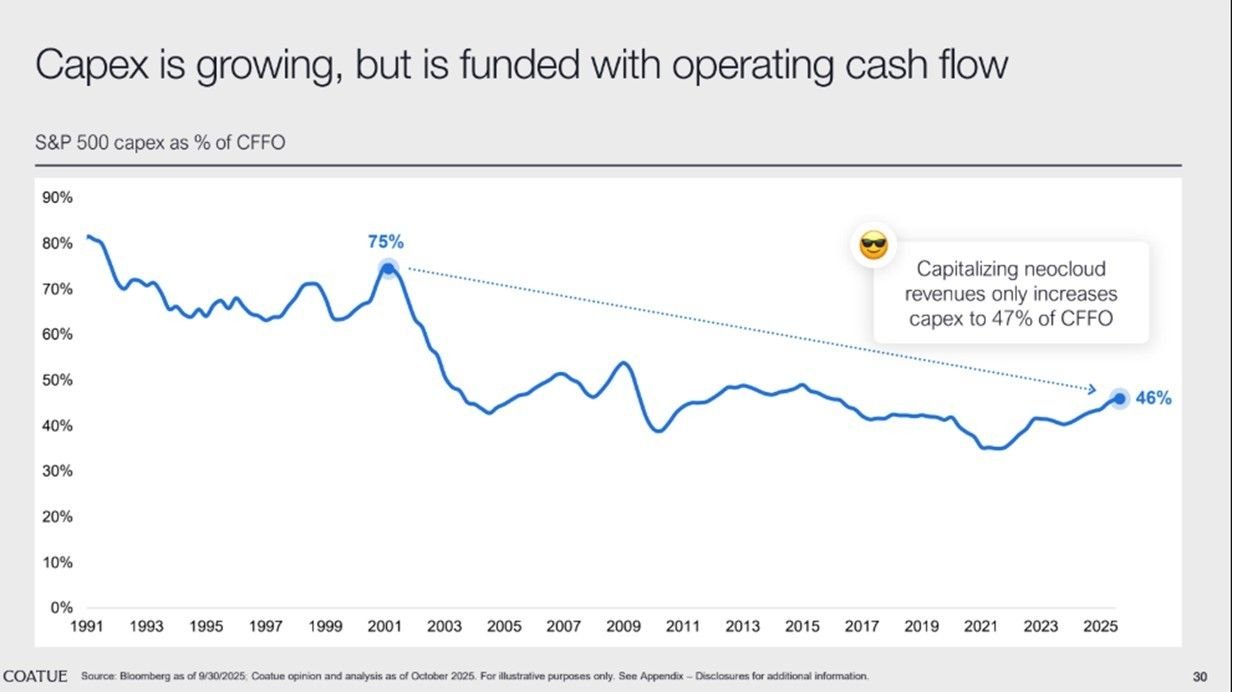

Free cash flow matters more than earnings. Big Tech today is healthier than in 2000, but FCF can be overstated by stock-based compensation, which is a real expense even if non-cash. Capex-to-sales ratios have risen but remain well below historical bubble levels, and most spending is funded with operating cash flow, not entirely on debt.

AMD’s Bold Bet on AI: Partnering with OpenAI

AMD is set to report earnings on November 4th after market close, and investors will be watching closely, especially after the company’s game-changing announcement last month.

In October, AMD revealed a mega deal with OpenAI to power the next generation of its AI infrastructure using up to 6 gigawatts of AMD Instinct GPUs. This forms part of OpenAI’s broader 23-gigawatt compute roadmap, which also includes major deals with Nvidia (10GW) and others.

The partnership cements AMD as a core compute provider to one of the fastest-growing companies in history. Interestingly, AMD granted OpenAI warrants to purchase up to 160 million AMD shares, roughly 10% of the company, a move that raised eyebrows among shareholders. While the dilution risk is real, it also strategically binds the two companies together for the long haul.

In return, AMD is expected to generate tens of billions in annual AI data center revenue starting in 2027. This deal could mark a major turning point for AMD as it challenges Nvidia’s dominance and strengthens its position at the heart of the global AI infrastructure buildout.

The Magnificent Seven: Dominating Earnings Season Once Again

As October draws to a close, the earnings season is far from over. Around 130 S&P 500 companies are still set to report in the first week of November, including Palantir Technologies, AMD, AirBnB, Duolingo, Uber and more. This follows the busiest stretch of the quarter, when more than 150 companies posted results.

So far, profits have been robust, about 82% of S&P 500 companies that have reported have exceeded earnings expectations, according to FactSet. But reactions haven’t all been positive. Meta Platforms plunged last week despite a strong quarter, as investors fixated on surging AI-related capital expenditures.

October’s results reinforced a clear narrative, the Magnificent Seven remain the market’s anchor. Of the six mega-cap tech names that reported, every single one beat revenue expectations, marking a 100% hit rate. Four also beat EPS, with Meta and Tesla as the exceptions, though both misses were more technical than fundamental.

Meta’s EPS shortfall came from a $16 billion one-time tax charge, masking strong ad growth and engagement trends. The company raised its AI capex guidance to $70–72 billion for FY2025, unnerving markets but underscoring its long-term commitment to AI infrastructure, the same backbone driving Meta’s ad engine and generative AI products.

Tesla, meanwhile, missed EPS by just $0.03 but achieved record deliveries of 462,000 vehicles and 52% energy segment growth. Margin pressure from pricing and ramp-up costs remains, but the bigger story is Tesla’s evolution, from a carmaker into an AI-driven autonomy and robotics leader, with Full Self-Driving, robotaxis, and humanoid robots paving the road ahead.

The Big3 Hyperscalers Beat, AWS Is Entering an AI Super Cycle

The hyperscalers all beat cloud estimates. AWS $33B (+20%), fastest in three years; Azure (+40%) with commercial bookings +111%—a leading indicator of locked-in multi-year AI revenue for Microsoft; Google Cloud $15.2B (+34%), backlog +46% to $155B. Cloud averaged +31% growth, proving AI capex is paying off. Guidance raised across the board, capex concerns overblown, S&P +2% this week—Nvidia next to fuel the AI rally.

AWS massive capacity ramp-up: Will add 1 GW of compute by year-end and double its Trainium2 chips, and Trainium3 could launch by year-end, and the Bedrock AI platform keeps scaling fast.

Mega data center buildout: Over the next 24 months, 10 GW of new capacity is coming online, one of the largest expansions in cloud history.

AI demand is exploding: In October alone, AWS signed $18B in new business, more than the entire Q3 combined.

Even with compute bottlenecks, AWS is outpacing expectations. Revenue growth is projected at +23% in 2025 and +25% in 2026, adding $6B from AI demand alone.

CapEx outlook? Raised again. Amazon could spend $169B in 2026 and $202B in 2027, mostly on AI infrastructure — more than Microsoft, Meta, or Google.