September Update

September 2025 proved to be a resilient month for global markets, defying historical trends of seasonal weakness. Traditionally, September has been the weakest month for U.S. stocks, with the S&P 500 averaging a -0.8% return based on long-term data. However, this year, equities pushed higher amid a Federal Reserve rate cut, softening labor data, and continued enthusiasm around AI-driven growth.

The Case for Q4: History’s Most Reliable Market Rally

If you had to pick just one quarter to bet on the market, history says Q4 is your best shot. On average, the fourth quarter delivers a +4.2% total return, the strongest of the year, compared to +3.8% in Q1, +1.9% in Q2, and +2.1% in Q3. Seasonality, optimism around the holidays, and year-end portfolio positioning often combine to make Q4 a sweet spot for investors. Even more compelling, when the S&P 500 hits a new high in September, the final stretch of the year tends to finish strong. In fact, 13 of the last 14 times this happened, Q4 delivered positive returns, a 93% win rate. Zoom out further, and the odds remain stacked in your favor, 20 of the last 22 times, Q4 finished higher, a remarkable 91% success rate.

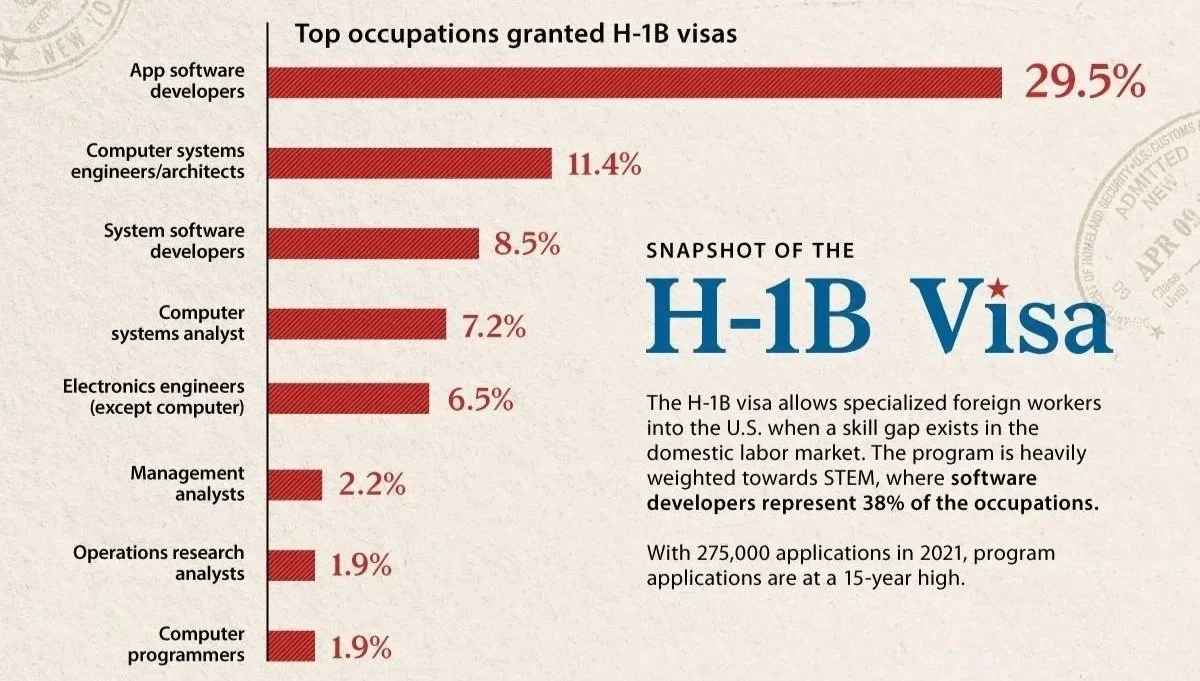

H-1B Visa Overhaul and Market Implications

A notable policy development with potential market implications was the overhaul in H-1B visa regulations. On September 19, 2025, President Donald Trump signed a proclamation titled "Restriction on Entry of Certain Nonimmigrant Workers," imposing a $100,000 fee on new H-1B visa petitions, effective September 21, 2025. This one-time fee, paid by employers, aims to curb abuses in the program and prioritize American jobs by making it costlier to hire foreign skilled workers, particularly in tech and high-skill sectors. The move sparked debates and lawsuits, with critics arguing it could disrupt talent pipelines for U.S. companies, while supporters see it as protecting domestic wages. It applies to new applications, including the FY 2026 lottery, but spares current holders. This change could ripple through labor markets, especially in industries reliant on global talent, potentially affecting hiring costs and innovation dynamics in the coming quarters. Indians make up the majority of H-1B holders, and this rule disproportionately affects them. Indian students and early-career professionals may now find the American dream more expensive — or even unreachable.

Push for Half-Yearly Earnings in the US

In mid-September 2025, President Donald Trump renewed his push to replace mandatory quarterly earnings reports for public companies with semi-annual ones, arguing via Truth Social that it would reduce costs and allow executives to focus on long-term growth rather than short-term pressures. The SEC, led by Trump appointee Paul Atkins, is prioritizing the proposal, which could align the U.S. with Europe and the U.K. by easing a 55-year-old requirement under the Securities Exchange Act. Supporters, including corporate leaders and long-term investors, hail it as a way to curb "short-termism," cut compliance burdens (potentially saving weeks of effort per report), and encourage innovation on issues like sustainability. Critics, however, warn it would diminish transparency, increase market volatility from less frequent disclosures, and disadvantage retail investors reliant on timely data, potentially eroding confidence and efficient capital allocation. If advanced through rulemaking—likely taking at least six months—this deregulation could reshape corporate priorities amid Trump's broader agenda, though its success remains uncertain.

Spotlight on MercadoLibre (MELI)

MercadoLibre (MELI), often dubbed the "Amazon of Latin America," faced a challenging September 2025, with its stock trending downward amid intensifying competition from Amazon in Brazil, its largest market. The decline accelerated toward the end of the month, with shares dropping 6.6% on September 30, triggered by Amazon's announcement of waiving Fulfillment by Amazon (FBA) logistics fees and reducing rates for new Brazilian merchants through the holiday season. This aggressive move by Amazon aims to attract more sellers and boost its presence in the region, raising investor concerns about potential erosion of MercadoLibre's market share in e-commerce. Combined with pressures from other competitors like Shopee, Shein, and Temu offering low-cost goods, the stock has fallen roughly 13% over the past three months, underperforming the broader market. Despite this, some analysts see it as a buy-the-dip opportunity, with Cantor Fitzgerald raising its price target to $2,900 on September 24, citing robust long-term growth in e-commerce and fintech. Over the past 52 weeks, MELI is up about 20.9%, but it closed around $2,135 in early October, down from its 52-week high of $2,614, with a market cap exceeding $108 billion. Brokerages maintain a "Moderate Buy" consensus, reflecting confidence in its expansion runway, while the company is countering competition with significant investments, planning $5.8 billion in Brazil for 2025 to enhance logistics, technology, and free shipping programs. Institutional interest continues, with recent amendments to credit agreements supporting further growth.

Q3 Earnings Season Ahead

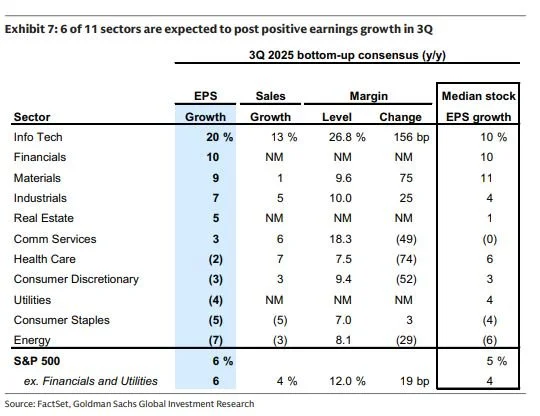

The S&P 500's 3Q earnings season starts the week of October 13, with 68% of companies (72% of market cap) reporting by month-end; Nvidia reports November 19. Consensus forecasts 6% year-over-year EPS growth, down from 11% in 2Q, but we expect beats driven by stronger sales and Mag7 surprises. Deceleration is still likely due to fading FX tailwinds, higher tariffs, and a 2Q one-time boost. Sales growth consensus of 4% (vs. 6% in 2Q) seems overly pessimistic, given nominal GDP growth of ~4.7% year-over-year per our economists.

Mag7 earnings growth consensus slows sharply to 14% in 3Q—half the Q1/Q2 pace—setting a low bar for mega-caps.

AI capex remains a hot topic: Hyperscaler updates on AI demand will shape the trade's future. Consensus sees 75% year-over-year capex growth in 3Q, decelerating to 42% in 4Q and ~20% in 2026, but spending has repeatedly topped estimates in recent quarters.

Debunking the Bubble Talk

“Economists have predicted nine of the last four recessions” - Paul A. Samuelson, Nobel Prize–winning economist.

Yes, valuations sit above long-term averages, and a short-term pullback would be healthy for the continuation of this secular bull market. But it’s important to note the clear distinctions between today and the dot-com era, and trying to time the “top” is not a viable strategy for a fund manager to make.

Market bears love to make noise at new highs - fear sells. Yet if hyperscalers’ massive CapEx wasn’t backed by real demand, if earnings disapeared overnight, and if OpenAI weren’t the fastest-growing company in history, we’d be having a very different conversation.

Margin Debt

- Margin debt is about 1.9% of the S&P 500’s market cap, below the historical 2.5% average and well under the 3.5% level in 2000.

- During the dot-com bubble, margin debt doubled from 1998–2000; today, leverage is far more contained.

Speculation vs. Quality

- In 1999, over 80% of IPOs were unprofitable.

- Today’s “Magnificent 7” collectively hold ~$0.5 trillion in cash, and 92% of S&P 500 IT companies reported profits in Q2.

- The focus is on earnings power and durable growth, not speculation.

Monetary Policy Context

- From June 1999 to May 2000, the Fed hiked rates six times, from 4.75% to 6.5%, pricking the bubble.

- Today’s backdrop is the opposite, we’re in a rate-cutting cycle, historically supportive for equities (though the labour market and migration trends remain key to watch).

Cold War 2.0 – The AI Race

- This isn’t about ideology but technological dominance.

- The AI race mirrors the Space Race, with DeepSeek as our “Sputnik moment”.

- The U.S. can’t afford to lose and won’t, given its control of advanced GPUs built from EUV lithography that China lacks.