Invest in Tomorrow, Today

At the heart of our investment philosophy is a commitment to identify growing companies that are shaping the future.

Our investment philosophy emphasizes long-term growth by selecting high-quality companies with earnings upside, driven by secular tailwinds, while prioritizing capital preservation and a disciplined, high-conviction approach. We believe that staying invested over time is more effective than trying to predict market movements.

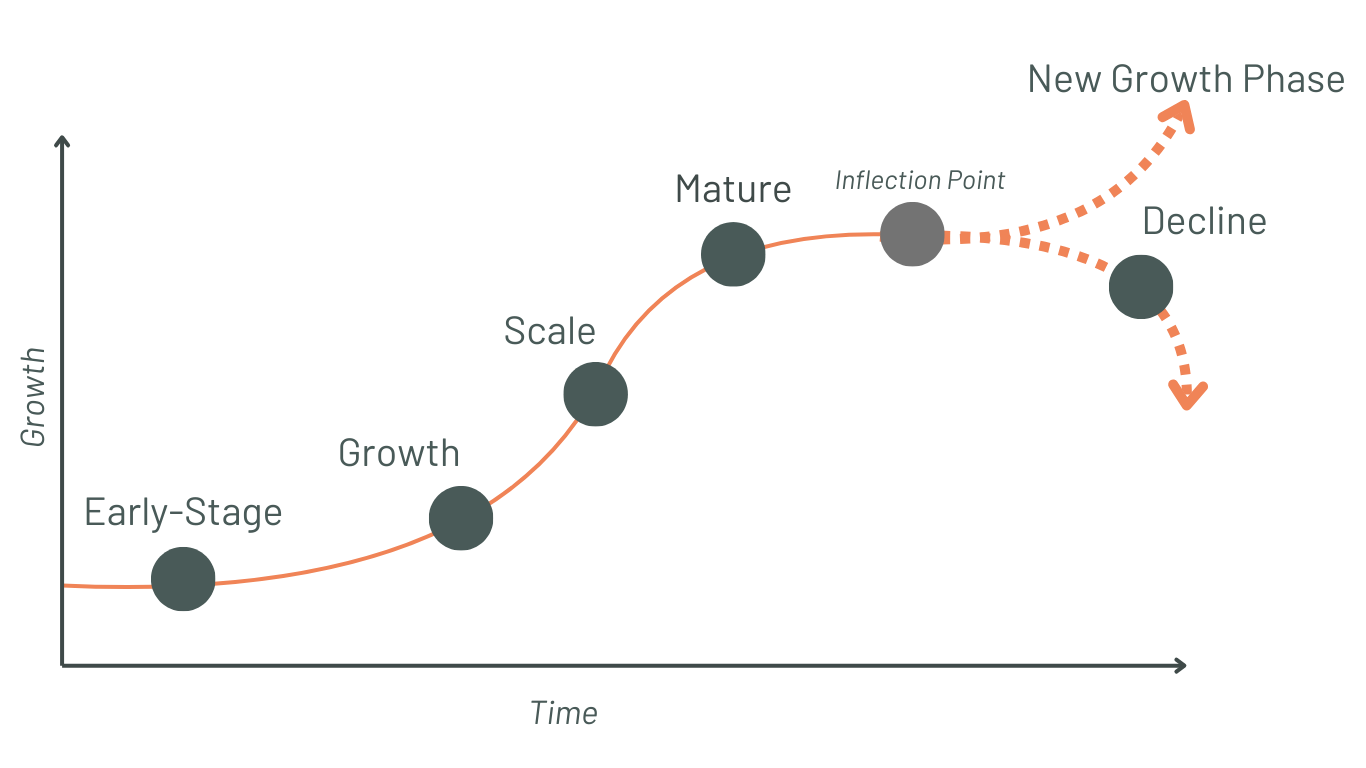

The S-Curve

The S-curve, or business life cycle, is a framework that illustrates the growth and adoption of innovations, technologies, or businesses over time through four distinct stages. Known as the S-Curve of Innovation or Growth, it represents a sigmoid (S-shaped) trajectory modeled mathematically by the logistic curve, showing how one variable grows in relation to another over time. This framework highlights how structural earnings growth, a hallmark of the S-curve, drives sustained stock price growth.

-

Early-stage companies, often backed by venture capital (VC), are characterized by their focus on product development, initial market entry, and efforts to achieve early traction. While revenue growth during this phase is typically exponential due to a small initial revenue base and rapid adoption by early customers, substantial investments in research and development (R&D), marketing, and operations frequently lead to negative earnings and an absence of surplus cash flow, as these companies essentially begin from scratch.

-

In the growth phase, a business concentrates on scaling operations and deepening market penetration to capture a larger market share. This stage is characterized by improved operational leverage, improved increasing free cash flows, reduced financial gearing and growing earnings, though earnings visibility can be volatile as the company continues to capture market share.

-

Growth rates slow to sustainable levels as market penetration peaks and competition is intensive. Revenue growth becomes steadier and more predictable, driven by incremental improvements, cost efficiencies, and diversification efforts. Surplus cash flow is strong, often directed toward maximizing shareholder value through dividends, share buybacks, or strategic investments.

-

Revenue and market share decline as the product or business becomes obsolete or faces competition from newer alternatives. Earnings growth turns negative, and surplus cash flow diminishes as demand contracts. Companies may pivot to new innovations, reduce operations, or divest from the declining product lines to sustain profitability.

Our Philosophy

Earnings Drives Share Price

Emphasize that revenue growth, margin growth, and free cash flow growth collectively contribute to earnings growth, which is the primary driver of share market returns over time. Put simply, share prices tend to follow profits.

Bottom-Up Approach

Active and fundamental bottom-up approach to stock selection. This involves evaluating financial health, management quality, competitive position, growth catalysts, and valuation metrics to identify undervalued stocks. This approach aims to identify quality businesses independent of broader economic conditions.

Structural Growers

Invests in businesses positioned for long-term growth, driven by secular tailwinds. Unlike cyclical trends, which are short-term and often tied to economic cycles, secular tailwinds are enduring and can last for decades.

Capital Preservation

Capital preservation, a bedrock investment principle, focuses on protecting your initial capital through low-risk strategies, ensuring you avoid the treacherous cycle of chasing losses.

Long-Term Focus

Sustainable, long-term capital growth by investing in listed companies with a business owner mindset. Prioritizing permanent capital preservation over short-term volatility, GSP engages deeply with management, conducts rigorous due diligence, and remains committed to long-term growth.

High Conviction

Best ideas with conviction. Studies show that managers' top picks generally add value, while smaller positions often detract from it [1]. Additionally, the diversification benefits of extra positions diminish quickly. This supports our approach of holding a smaller number of well-understood positions [2].

[1]: "The Performance of Mutual Fund Managers' Top Stock Picks". Authors: B. M. Barber, T. Odean. Publication: Journal of Portfolio Management (2018). Summary: This research demonstrates that the best stock picks by mutual fund managers often perform better compared to smaller positions within their portfolios.

[2]: "The Role of Diversification in the Performance of Equity Portfolios". Authors: M. M. G. E. and R. E. H. Publication: Journal of Financial and Quantitative Analysis (2020). Summary: This study shows that the marginal benefits of adding additional positions to a portfolio diminish quickly after a certain number of holdings, supporting the strategy of maintaining a smaller, well-understood set of positions.