GSP IMA Service

What are Individually Managed Accounts (IMAs)?

An Individually Managed Account (IMA) is a personalised investment portfolio held in your name and tailored to your financial goals, risk profile, and preferences. Your IMA may invest in direct shares, selected mix of ETFs, managed funds, and other assets, chosen specifically for you. This structure provides transparency and flexibility, with the ability to adjust your portfolio as your circumstances and markets evolve.

How GSP’s IMA service works

At GSP, your IMA is designed from the ground up around you. We work closely with you and your adviser if applicable to create a bespoke investment portfolio that matches:

Your Investment Objective

Your risk tolerance (how much volatility you’re comfortable with)

Any specific requirements (e.g. growth focus, income focus, active vs passive etc.)

Plus, you'll enjoy direct access to our seasoned portfolio managers, who handle every decision, and investment committee assessment of market conditions.

Portfolio Details

Investment Approach

Portfolios are designed around a growth and income framework, tailored to your individual objectives and risk tolerance, ensuring your investments are aligned with both your short- and long-term financial goals.

Portfolio Holdings

Our portfolio includes growth assets like Australian and Global equities, ETFs, and managed funds; income assets such as fixed income securities, option-based strategies, and cash; and flexibility for alternatives like private equity, venture capital, and real assets to enhance diversification.

Our Clients

High-Net-Worth Individuals, SMSFs, Family trusts, companies & NFPs.

Portfolio Services

GSP IMA Service: Typically suited for portfolios of $1,000,000+.

Discretion may be applied for specific criteria.

Eligibility

GSP’s IMA service is ideally suited to high-net-worth individuals (wholesale or sophisticated investors under the Corporations Act 2001 (Cth) (Corporations Act)) or institutional investors seeking an investment solution tailored to meet individual investment goals and objectives.

To qualify for an IMA, you typically need to meet certain criteria, which include:

• A minimum investment amount of $500,000.

• Being classified as a Wholesale or Sophisticated Investor under the Corporations Act 2001 (Cth).

• Agree to the terms and conditions outlined in the IMA agreement.

Ready for your own Exclusive IMA?

Start with a no-obligation discovery meeting with our Private Client team.

→ Complete the contact form to request an initial 15-minute call

→ No cost, no obligation

→ We’ll review your current situation and outline a tailored, no-obligation proposal

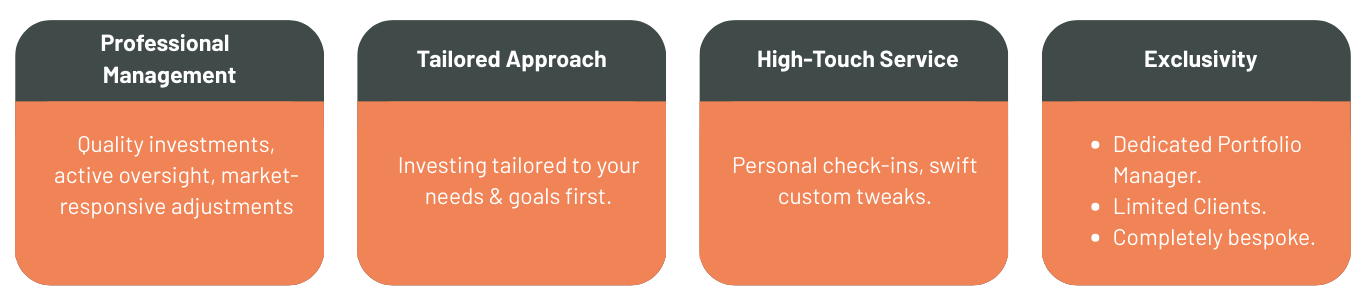

Advantages

Access to strategies and investment opportunities typically reserved for exclusive investors.

100% tailored portfolio – no “one size fits all.” Your portfolio is built specifically around your unique goals, risk tolerance, situation, and values.

You own the individual stocks and assets directly in your own name (better tax management, full transparency, and no layered fund fees).

Direct relationship with the decision-makers, real-time visibility of your holdings and performance through an industry-leading platform, plus ongoing detailed reporting and personalized contact whenever you want.