In The Press: Ausbiz TV - The key players in an increasingly cyber-savvy world

21st January, 2026

Huw Davies, Portfolio Manager, joined Ausbiz TV to discuss the rapidly intensifying cyber security landscape, noting that geopolitical instability and accelerating technological change are driving a sharp rise in global cyber risk. He highlighted the sector’s fragmentation alongside a clear shift toward platform leaders such as Palo Alto Networks, CrowdStrike, Fortinet and Cloudflare, which are leveraging AI to both counter increasingly sophisticated attacks and deliver more scalable, integrated security solutions as cyber threats continue to grow in scale and complexity.

Watch Video: The key players in an increasingly cyber-savvy world

Cyber Security Takes Centre Stage in an Increasingly Unstable World

Cyber security has moved from a back-office IT function to a frontline strategic priority for governments and businesses alike. As geopolitical tensions rise and the global economy becomes more digitally interconnected, cyber risk is accelerating in both scale and sophistication. According to Grey Street Partners Portfolio Manager Huw Davies, this shift is structural—not cyclical—and is reshaping how organisations think about security spending, technology architecture, and long-term resilience.

Geopolitics Is Fueling a New Wave of Cyber Threats

Recent geopolitical developments are materially expanding the cyber threat landscape. Escalating tensions involving the United States, Venezuela, and Iran have increased state-sponsored and proxy cyber activity, adding to an already complex risk environment. Cyber warfare has become a low-cost, high-impact tool for nation states, blurring the line between traditional conflict and digital aggression.

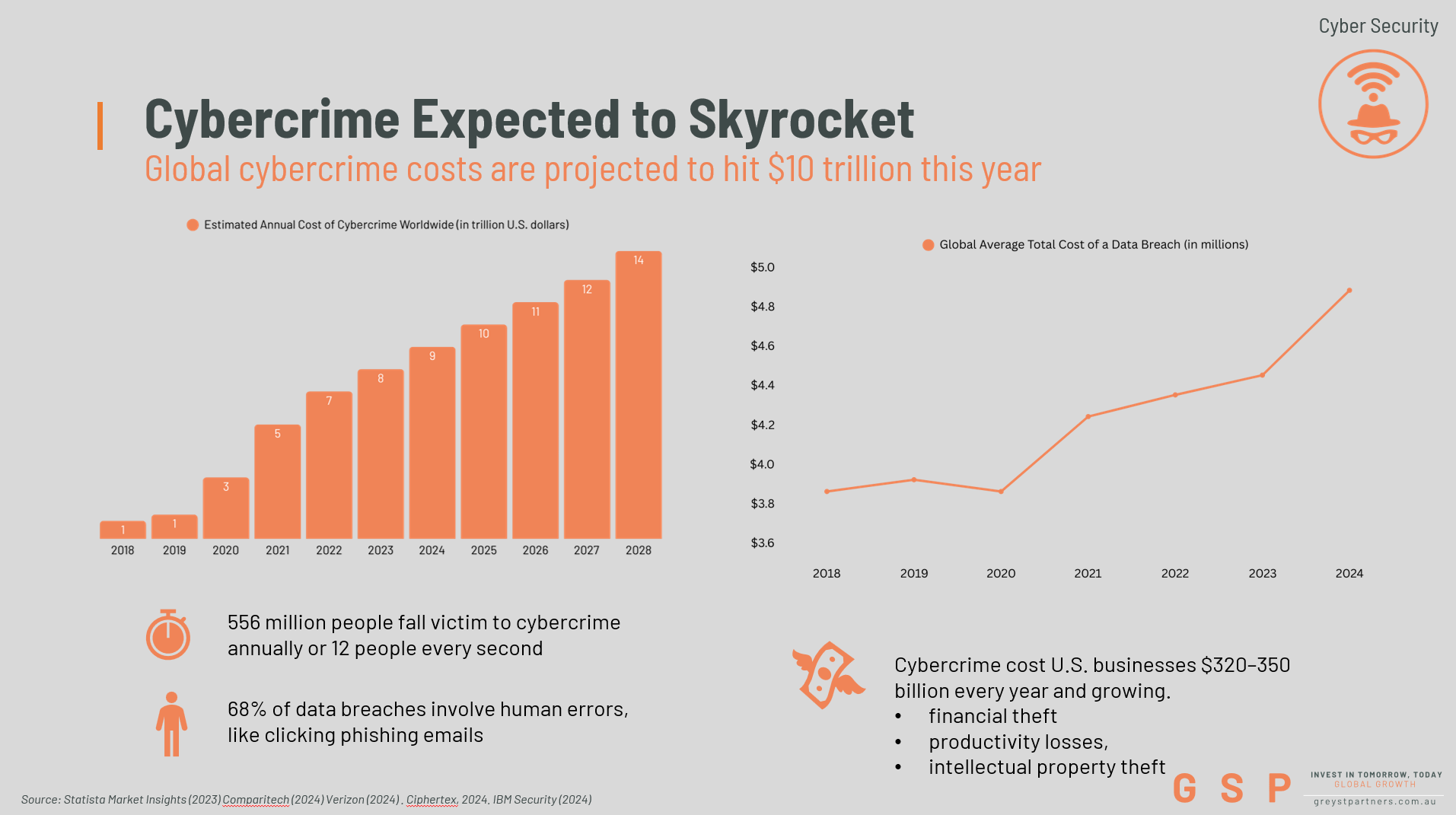

The economic consequences are staggering. Global cybercrime costs are projected to reach between US$10 trillion and US$10.5 trillion by 2025, up from just US$3 trillion in 2015. In 2024 alone, cybercrime inflicted an estimated US$9.22 trillion in global damages—an economic footprint comparable to the world’s third-largest economy. For businesses, the impact is not just financial loss, but operational disruption, intellectual property theft, reputational damage, and long-term erosion of trust.

A Fragmented Industry Undergoing Structural Change

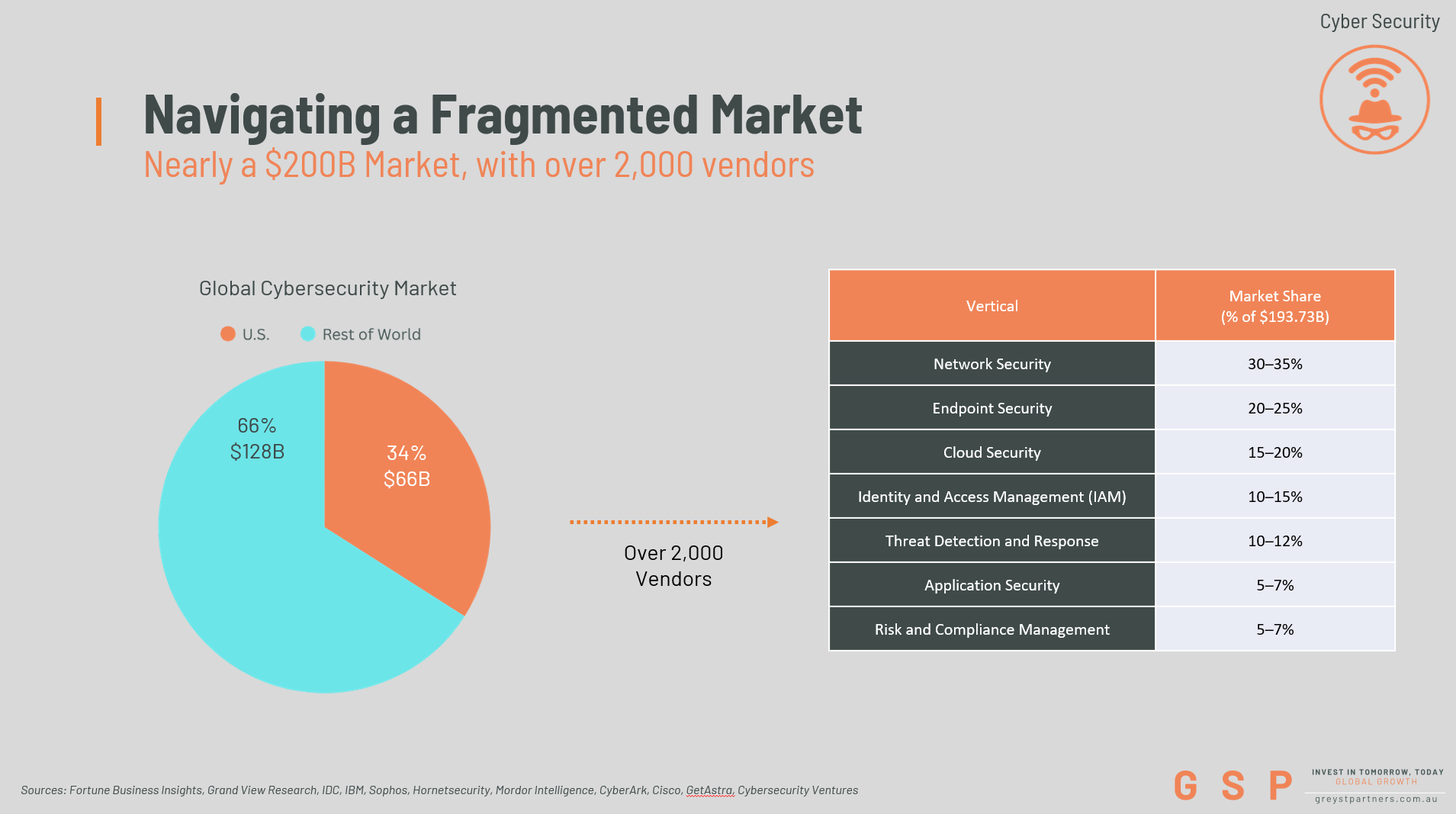

Despite its size and importance, the cyber security sector remains highly fragmented. More than 2,000 vendors offer specialised tools across network security, endpoint protection, cloud security, identity management, and threat detection. This fragmentation has created widespread “tool sprawl,” with many enterprises running 20 to 50 disconnected security tools—often leaving gaps that attackers can exploit.

Yet within this complexity, a clear structural trend is emerging: platformisation. Leading vendors are consolidating multiple security functions into integrated, cloud-native platforms that are easier to manage, more effective at threat detection, and better suited to modern IT environments.

Davies highlights Palo Alto Networks (NASDAQ: PANW), CrowdStrike (NASDAQ: CRWD), Fortinet (NASDAQ: FTNT), and Cloudflare (NYSE: NET) as key beneficiaries of this shift. While thousands of smaller players compete for niche market share, the top 20 vendors already capture 30–50% of global cyber security spend—a figure likely to rise as customers prioritise consolidation and scale.

Artificial Intelligence: Threat Multiplier and Defence Engine

Artificial intelligence is rapidly reshaping both sides of the cyber battlefield. On the offensive side, AI is being used to automate attacks, scale phishing campaigns, and identify vulnerabilities faster than ever before. On the defensive side, AI is becoming essential for real-time threat detection, faster response times, and predictive risk management.

Despite advances in technology, human error remains the weakest link. Around 68–80% of cyber incidents still involve user mistakes, such as clicking phishing emails. At the same time, the expansion of cloud computing, remote work, and internet-connected devices continues to widen the attack surface.

This dynamic makes advanced, AI-driven platforms increasingly critical. Companies that can analyse threats across networks, endpoints, identities, and cloud environments—while responding in real time—are best positioned to protect customers and capture long-term growth.

Palo Alto Networks: A Case Study in Platform Leadership

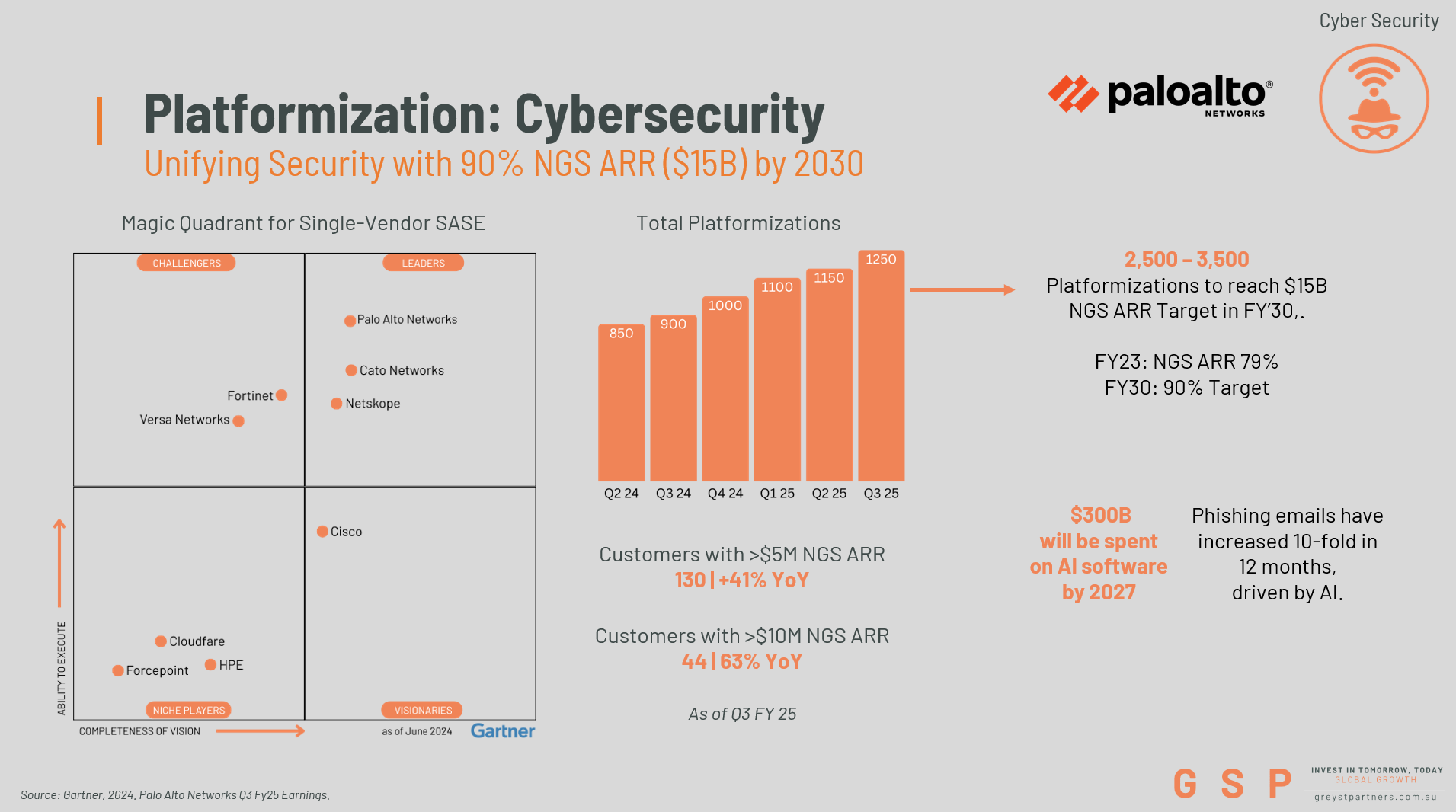

Founded in 2005, Palo Alto Networks has evolved from a next-generation firewall company into one of the most comprehensive cyber security platforms globally. Through major platform expansions such as Strata (network security), Prisma (cloud security), and Cortex (AI-driven threat detection), the company has built an integrated, cloud-native security ecosystem trusted by over 70,000 organisations, including 85 of the Fortune 100.

Palo Alto’s platform strategy is central to its competitive edge. By unifying security tools into a single architecture, the company reduces complexity, closes security gaps, and improves customer outcomes. This approach has driven strong commercial results, including net revenue retention of around 120% and a growing share of recurring, next-generation security revenue.

The company’s long-term ambition is clear: by 2030, management targets 90% of revenue to come from next-generation, platform-based solutions, reaching approximately US$15 billion in annual recurring revenue. Fully platformised customers generate significantly higher revenue—often millions of dollars per year—compared to those using standalone products.

Industry recognition reinforces this positioning. Palo Alto Networks is the only vendor recognised as a Leader across Gartner’s Magic Quadrants for Single-Vendor SASE, Security Service Edge (SSE), and SD-WAN, reflecting its breadth, integration, and execution.

A Structural Growth Theme, Not a Passing Cycle

Cyber security is no longer optional, discretionary, or cyclical. It is a foundational layer of the modern digital economy. Governments are increasing budgets, enterprises are consolidating vendors, and regulatory pressure continues to rise. In the United States alone, federal agencies allocated over US$12 billion to cyber security in 2024, while North America accounts for nearly 44% of global cyber security spending.

For investors, the opportunity lies not in chasing every new tool or niche solution, but in identifying platform leaders with scale, integration, and durable competitive advantages. As Huw Davies highlights, the convergence of geopolitics, AI, and digital dependency is creating a powerful, long-term tailwind for the sector—and those companies best positioned to secure the digital world stand to benefit most.