In The Press: Ausbiz - Two Disruptive Healthcare Stocks To Watch

12th January 2026

Huw Davies, Portfolio Manager, joined Ausbiz TV to discuss key healthcare disruptors, highlighting robotic surgery and organ transplantation as major growth areas. He pointed to Intuitive Surgical (NASDAQ: ISRG) as the global leader in robotic surgery with a long runway for growth, and TransMedics (NASDAQ: TMDX) for improving transplant outcomes through its Organ Care System. Huw also noted that AI and technology integration will be critical in scaling healthcare solutions and improving patient outcomes.

Watch Video: Robotic surgery stocks poised for takeoff as AI transforms healthcare

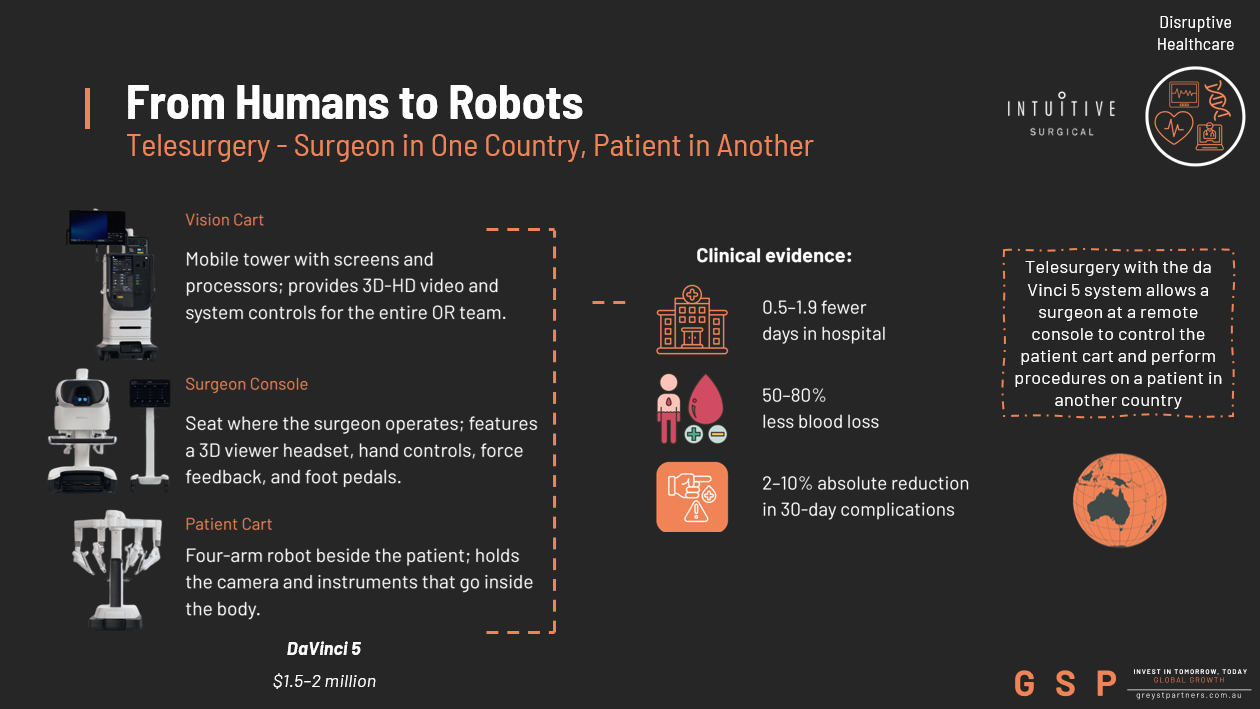

From Humans to Robots: Intuitive Surgical (ISRG)

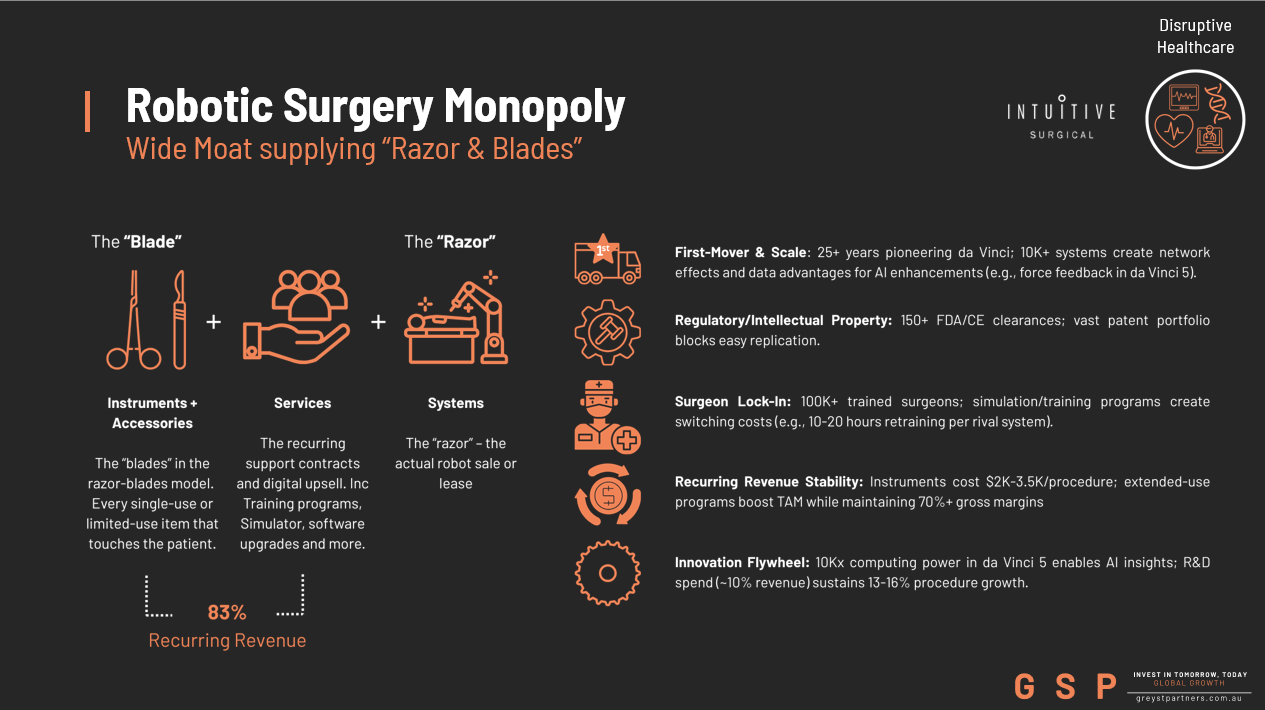

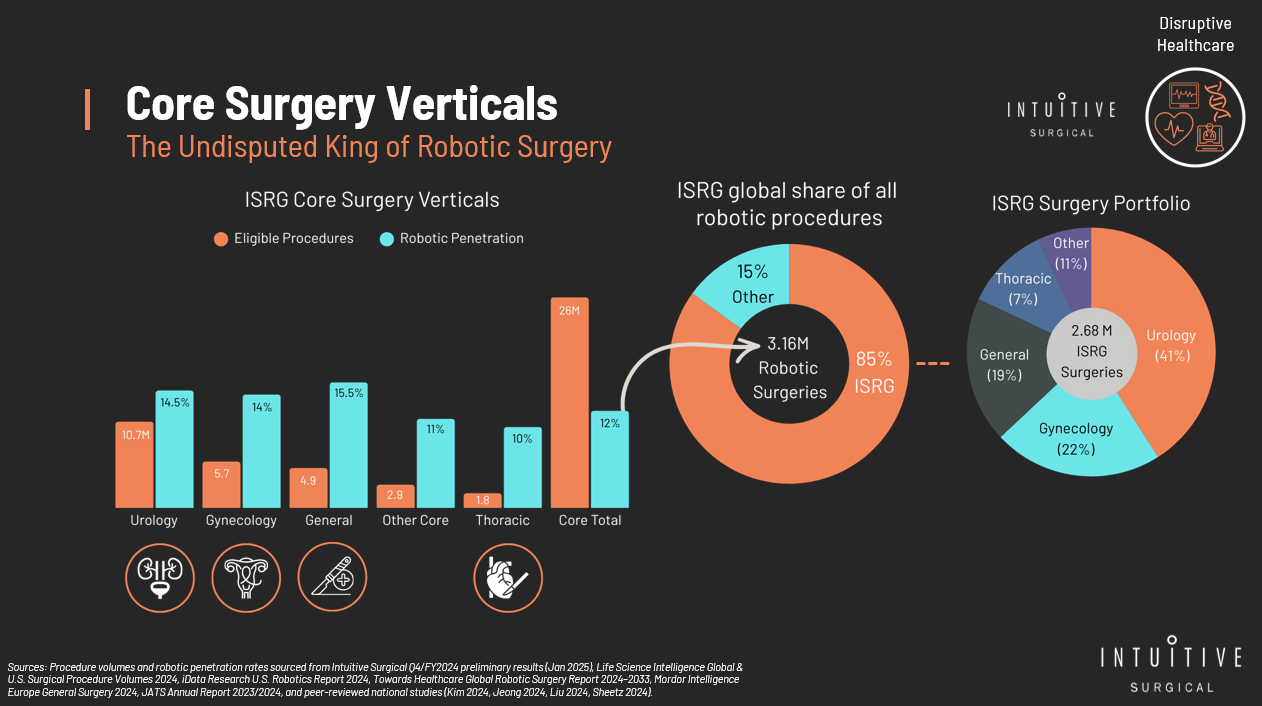

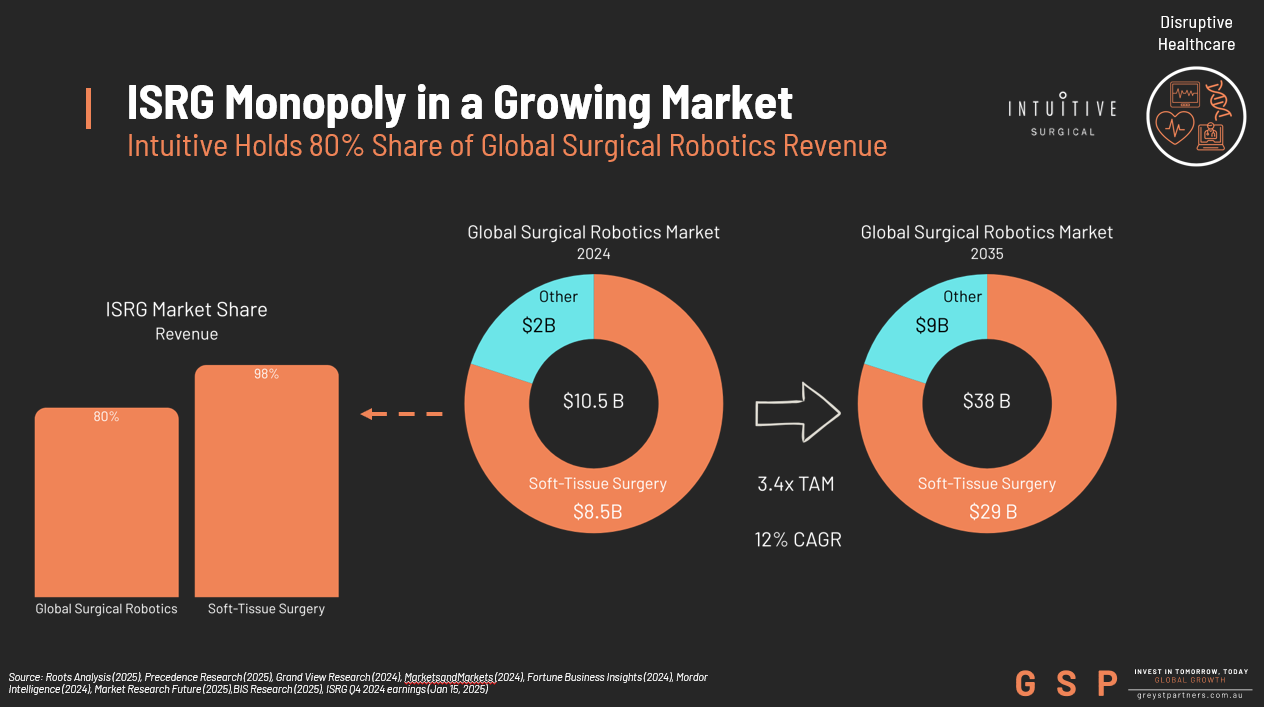

Robotic-assisted surgery, led by Intuitive Surgical’s da Vinci platform, has become the gold standard for complex minimally invasive procedures in urology, gynecology, general surgery, and thoracic surgery. It solves the biggest pain points of traditional laparoscopy and open surgery: poor depth perception, rigid instruments, hand tremor, and surgeon fatigue.

Key advantages that drive the shift:

True 3D HD vision vs. flat 2D laparoscopy

Wristed instruments with 7 degrees of freedom (more than the human hand)

Tremor filtration and motion scaling for sub-millimeter precision

The clinical evidence is now overwhelming (2024–2025 meta-analyses covering >1 million cases):

0.5–1.9 fewer hospital days in hospital

50–80% less blood loss

2–10% absolute reduction in 30-day complications (No difference in long-term cancer outcomes vs. open/lap)

Despite these benefits, global robotic penetration remains tiny: <1% of the ~300 million annual surgeries worldwide, and only ~10–11% in ISRG’s four core verticals (26 million eligible procedures).

The upfront cost of a da Vinci system (~$1.5–2 million) plus consumables remains the main barrier — but as reimbursement expands and outcomes data compounds, adoption is accelerating fast.

In 2001's "Operation Lindbergh," surgeons in New York (USA) used a da Vinci precursor to remove a patient's gallbladder in Strasbourg, France—over 6,000 km apart.

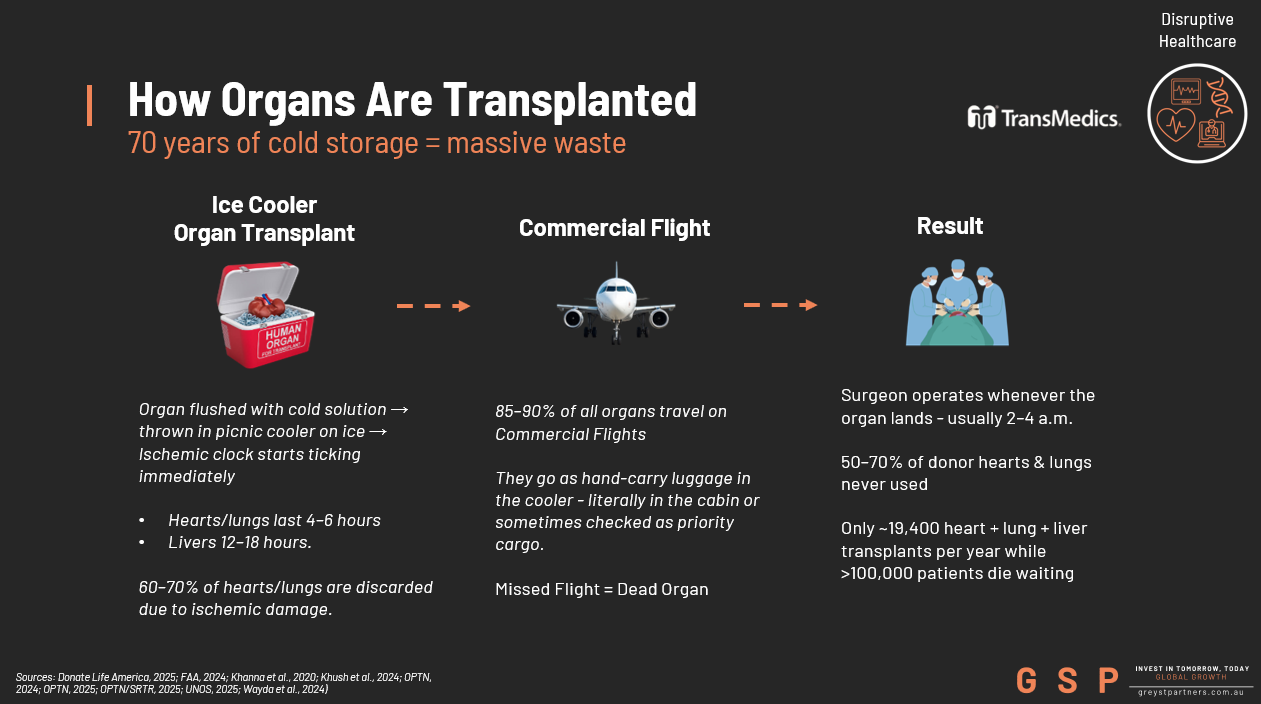

From Ice Buckets to Machines: Transmedics (TMDX)

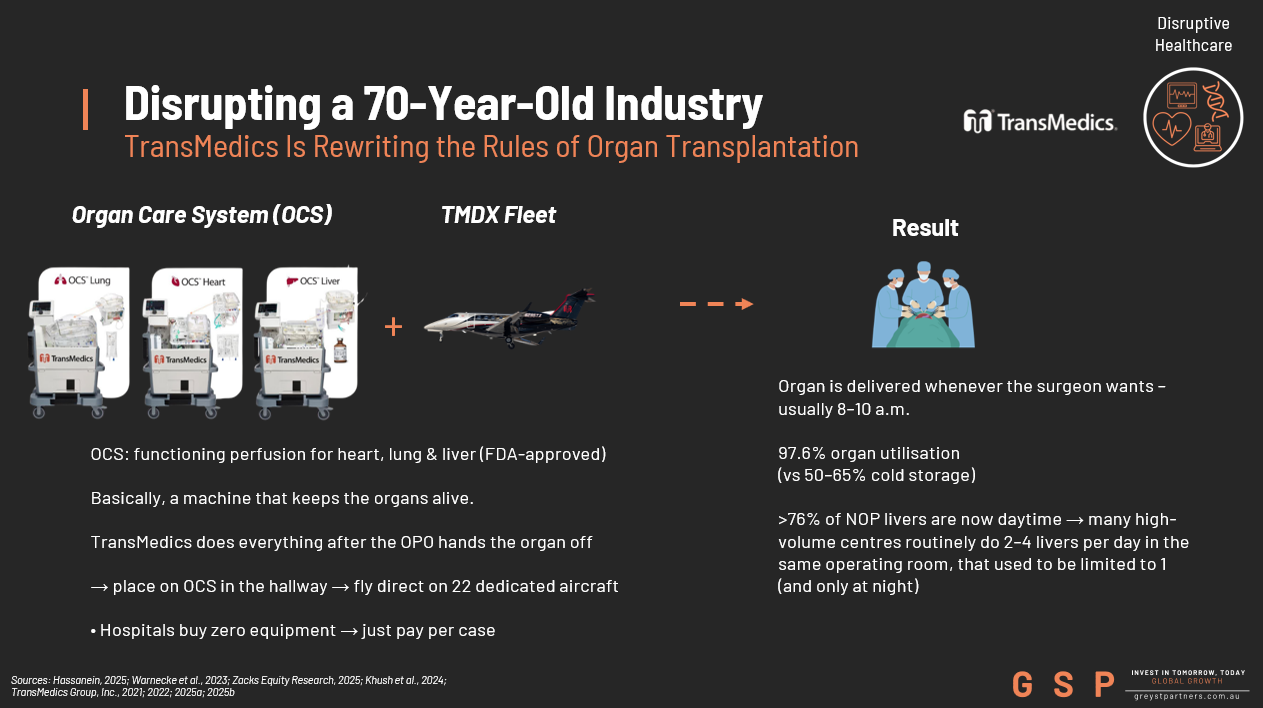

TransMedics is revolutionizing organ transplantation by replacing outdated cold storage methods with its FDA-approved Organ Care System (OCS), which keeps hearts, lungs, and livers warm, perfused, and functioning during transport. Through its National Organ Procurement (NOP) program, TMDX handles end-to-end logistics using a fleet of 22 private jets, specialized teams, and perfusionists—delivering viable organs directly to surgeons during optimal daytime hours. This reduces waste (60-70% of donor hearts/lungs discarded traditionally), minimizes ischemic damage, and enables use of marginal donors like DCD cases.

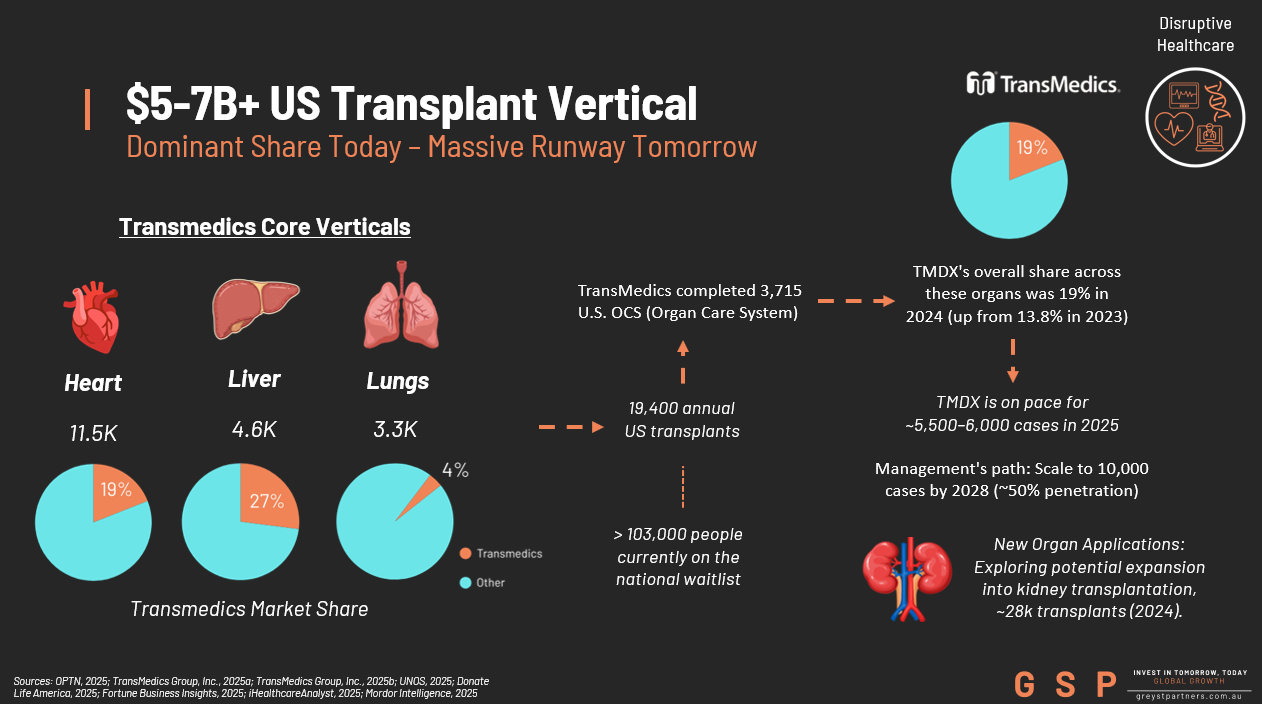

The U.S. transplant market for these organs is $5-7B, with TMDX targeting the 10-15% preservation/devices segment ($500M-$1.05B TAM). In FY24, TMDX generated $441M revenue (42-88% penetration), dominating with 27% liver share (over 50% in DCD), 19% hearts (66% DCD), and 4% lungs—indicating massive upside in lungs. Q3 2025 revenue hit $143.8M (+32% YoY), with full-year 2025 guidance at $585-605M (+35% growth). Over 100K waitlisted patients face donor shortages (only 1% of deaths suitable), but TMDX boosts supply efficiency.

As a stock, TMDX offers strong growth: profitable (16% net margin), 99% institutional ownership, and expansion into kidneys/Europe. Market cap ~$4.7B, with Zacks #3 Hold and 20%+ projected 2026 sales growth, it's positioned for sustained gains amid unmet demand.