Mini Series: Why Battery Demand Is Set to Skyrocket

18th February, 2026

The world is in the middle of a renewable energy revolution.

But here’s the uncomfortable truth: it’s slower than most headlines suggest.

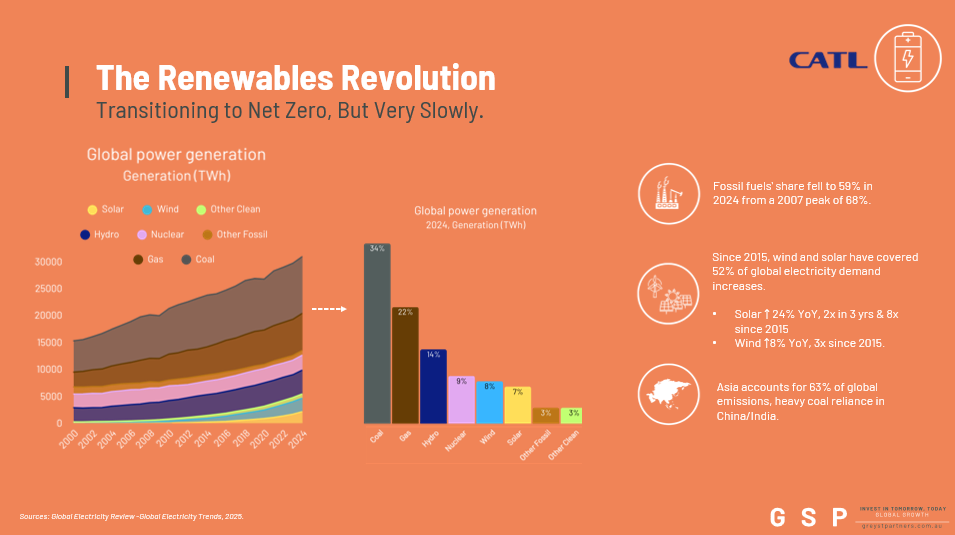

Despite years of climate pledges and net-zero targets, fossil fuels still dominate the global energy mix. In 2024, global power generation surpassed 30,000 terawatt-hours. Of that, roughly 59% still came from fossil fuels. That’s an improvement from the 68% peak in 2007 — but it’s hardly a clean-energy world.

And the regional imbalance is stark.

Asia produces around 63% of global emissions, largely driven by heavy coal reliance in China and India. Meanwhile, parts of South America and Africa still generate only 3–4% of their electricity from clean energy sources.

So yes, the transition is happening.

But no, we are not hitting net zero anytime soon.

The Shift Is Real — And Wind & Solar Are Leading It

While fossil fuels remain dominant, the direction of travel is clear.

Since 2015, wind and solar have supplied more than half of all new electricity demand globally. Over that same period:

Solar power generation has increased eightfold

Wind power has tripled

Costs have continued falling, accelerating adoption

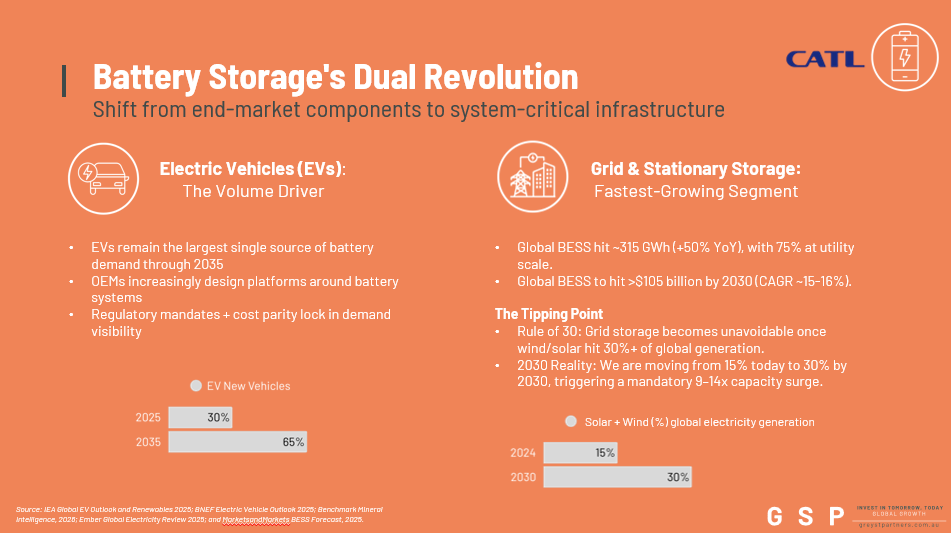

Solar and wind now account for roughly 15% of global power generation. That may not sound like much — but once renewable penetration approaches 30% (projected around 2030), the energy system fundamentally changes.

Because intermittent power requires storage.

And that’s where the real story begins.

Battery Demand Is No Longer Cyclical — It’s Structural

Battery demand isn’t tied to a short-term cycle anymore. It’s becoming structural.

Think about semiconductors after COVID. Demand surged. Supply chains tightened. Then AI accelerated everything.

Batteries are on a similar trajectory.

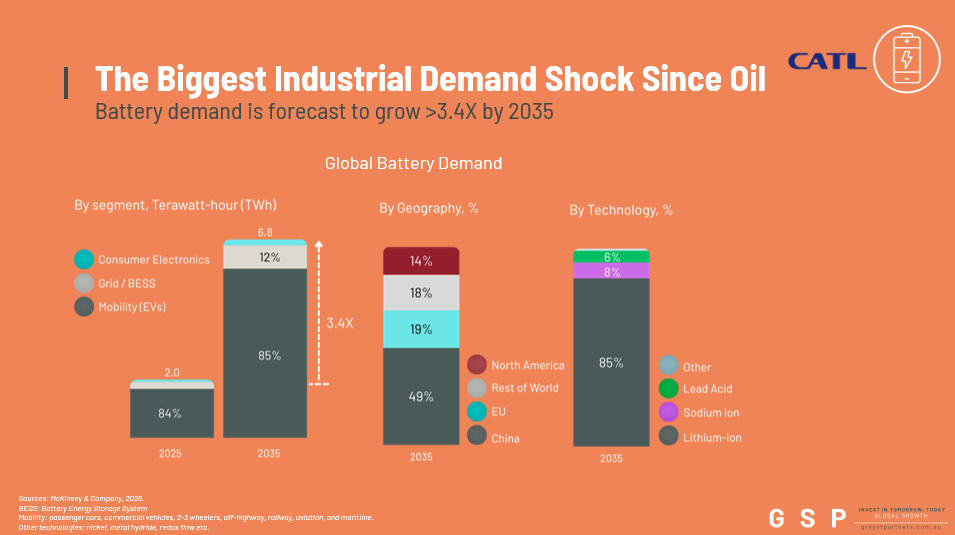

Global battery demand is projected to grow from roughly 2 terawatt-hours in 2025 to nearly 7 terawatt-hours by 2035 — a 3.5x increase. It’s expected to double within just five years.

And this growth is not speculative.

It’s already underway.

EVs: The Primary Growth Engine

Electric vehicles are the dominant driver of battery demand — accounting for roughly 85% of expected growth.

Last year, EVs represented 25–30% of new car sales globally. By 2035, that figure could reach 60–65%.

At scale, batteries are replacing internal combustion engines.

The transition is no longer about “if” — it’s about “how fast.”

Grid Storage: The Silent Multiplier

The second-largest driver of battery growth is grid storage, expected to account for around 12% of demand growth.

As wind and solar penetration rises, grid-scale battery systems become non-negotiable. Renewable energy must be stored and dispatched during peak demand periods.

Once renewables hit 30% penetration, storage becomes essential infrastructure — not optional add-on technology.

Grid-scale battery installations are expected to grow tenfold over the next decade.

In other words, batteries are becoming the “picks and shovels” of the modern energy gold rush.

China’s Dominance in the Battery Supply Chain

When it comes to battery production, one country dominates.

China produces approximately 70–80% of global lithium-ion batteries. It leads in electric vehicles, grid storage deployment, and battery chemistry innovation.

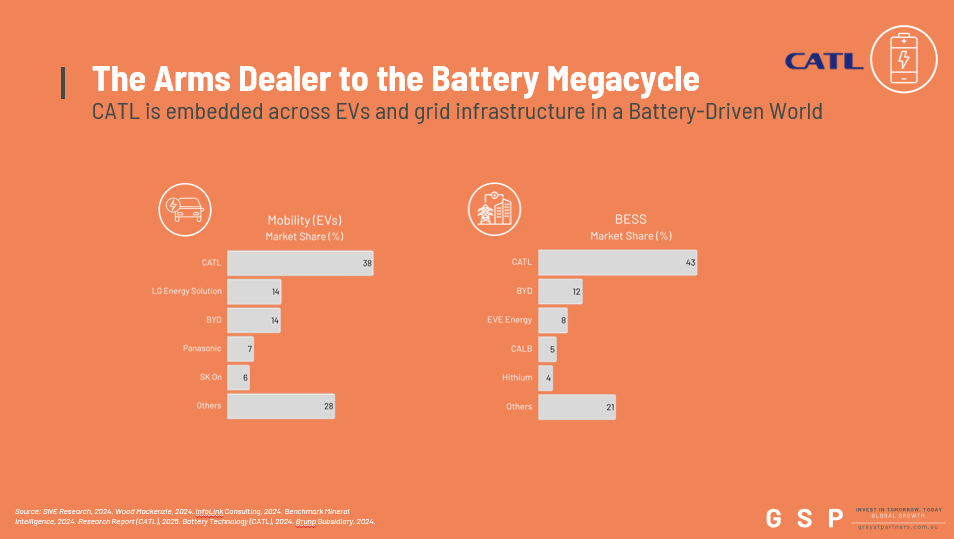

The global leader is Contemporary Amperex Technology, commonly known as CATL.

Powers roughly 38% of electric vehicles worldwide

Supplies around 43% of global grid storage systems

Close behind is BYD, which has vertically integrated battery and EV manufacturing capabilities.

Meanwhile, Tesla has entered the lithium refining race, launching what is now the largest lithium refinery outside of China as of January this year — a strategic move aimed at reducing supply chain dependence.

The battery race is not just about technology.

It’s about geopolitics.

And We Haven’t Even Mentioned Robotics

Most forecasts focus on EVs and grid storage.

But what happens if humanoid robotics scales?

Advanced robotics platforms — particularly those integrating AI — will require high-density battery systems. If robotics adoption accelerates this decade, it becomes another structural demand layer.

We may be underestimating total battery demand.

The Bigger Question

Are we witnessing the gradual end of combustion engines?

Will solar adoption continue compounding?

And will batteries become the defining industrial commodity of the next decade?

The renewable transition may be slower than activists hope.

But the structural shift in batteries is accelerating faster than most investors realise.

The energy revolution isn’t just about generating clean power.

It’s about storing it.