Quick Bites: Is Enterprise Software Dead?

3rd February, 2026

📈 The Market is Pricing in Fantasy. Here is the Reality.

First, it’s worth acknowledging that global growth hasn’t had an easy run these past few months, things have been especially volatile. We’ve had to digest extreme AUD/USD volatility which made up a lot of the pain over this period, we are seeing Gold and Silver are swinging violently, and and underneath the surface of US equity indexes, there is serious chaos, particularly in Enterprise Software.

The Fantasy vs. The Reality

At the moment, the market is dumping the entire enterprise software complex because it can’t yet separate AI winners from losers. It is a classic “sell the rumour, buy the facts”. The market is living in a fantasy land and selling software names indiscriminately, but there will come a point when things move back to reality. When fundamentals move from the back seat into the drivers seat.

“Who wins? Who loses?”

The Fantasy: The market seems to think AI disruption means enterprise software is suddenly obsolete, that anyone can code from their basement and instantly displace incumbents.

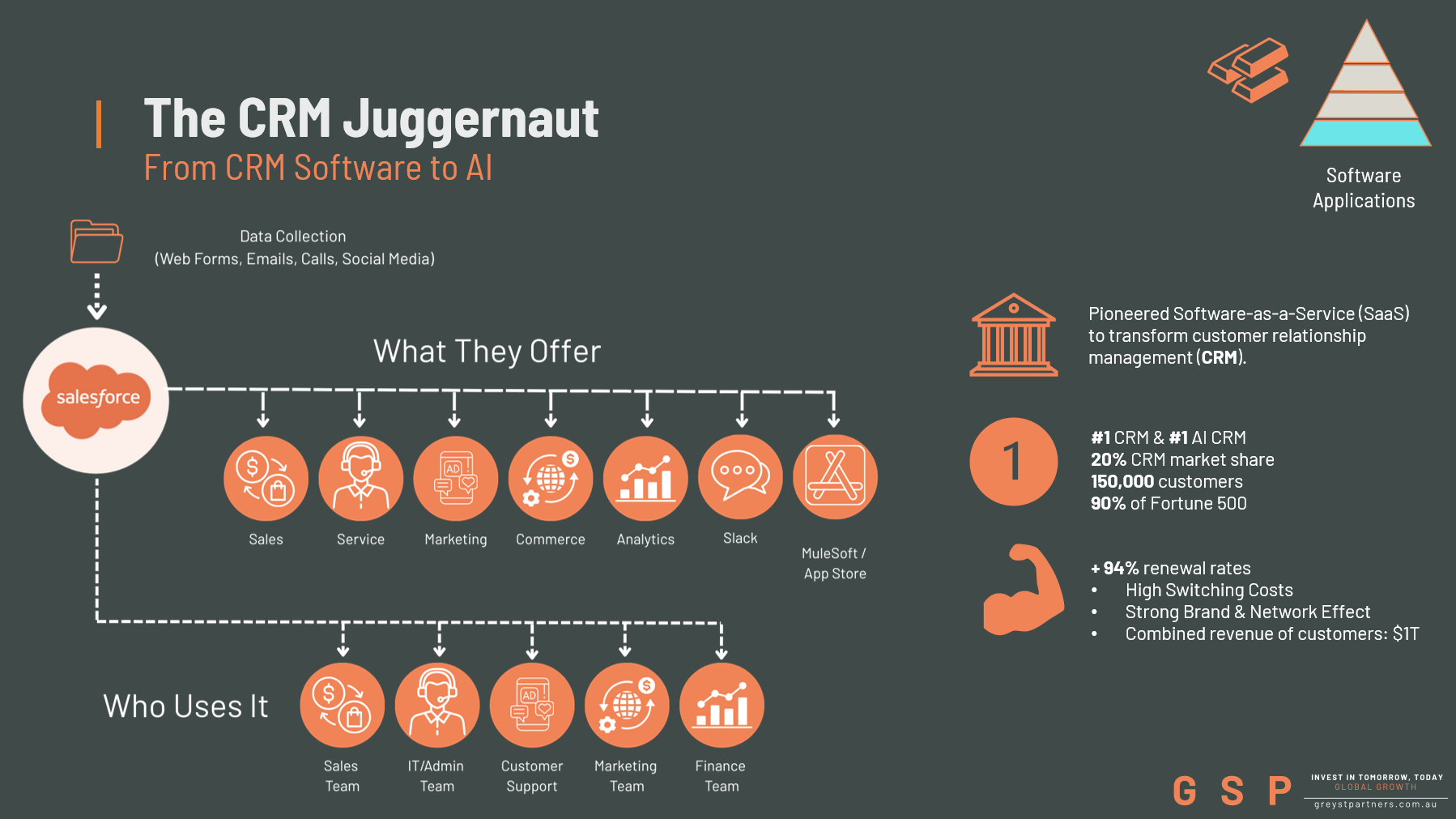

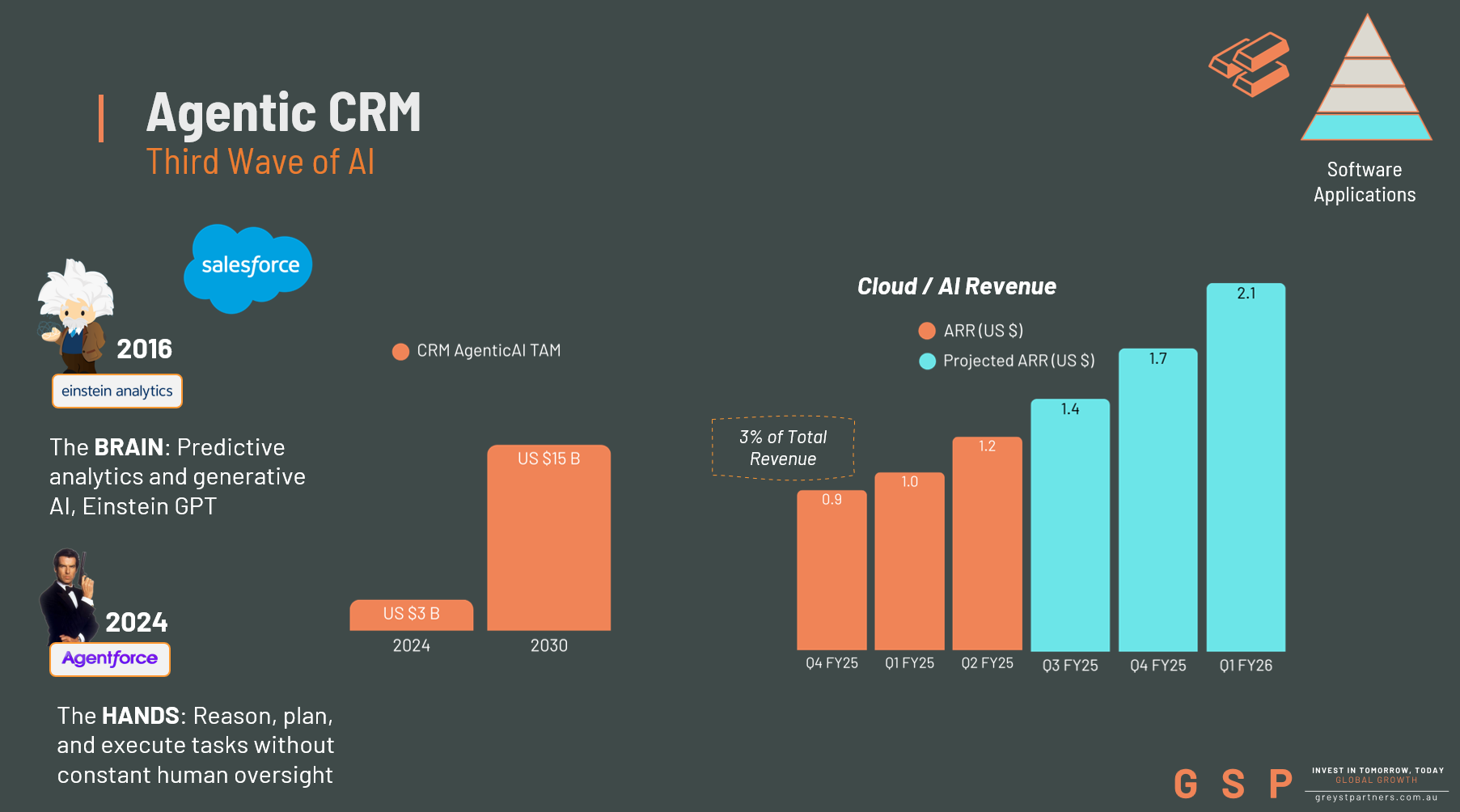

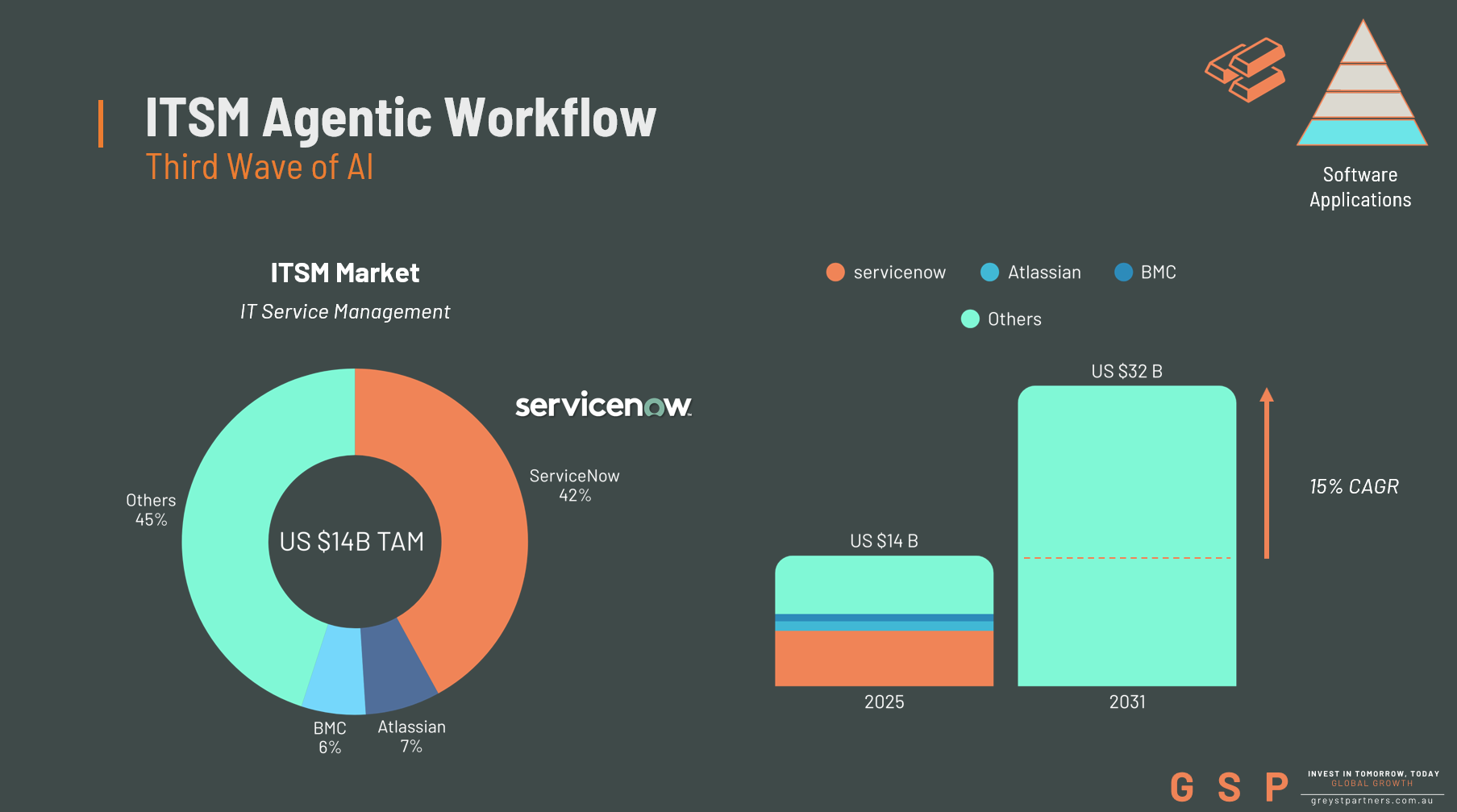

The Reality: Copying a recipe doesn’t make it a Michelin-star dish. The moat of enterprise software has never been just “code”. It’s customer stickiness, embedded workflows, and proprietary data, especially for medium-to-large enterprises.

Migrating a core system like Salesforce or ServiceNow? It’s:

Expensive – time, money, effort.

Risky – data integrity, security.

Deeply disruptive – training, migration, downtime.

No Fortune 500 company is handing mission-critical systems to unproven AI startups just because LLMs exist.

People keep asking: When will we know the winners and losers?

My answer: Follow the earnings, not the noise.

Earnings are the “reality”. Some standalone, lightweight software companies with low switching costs will see features replaced by AI fast. But entrenched platforms, where the moat is workflow integration + proprietary data + switching friction, will win, because AI becomes an accelerator, not a destroyer. It accelerates commoditization where moats are weak, but struggles against deeply embedded systems. It drives commoditization where moats are weak, but struggles against deeply embedded enterprise systems.

“The market is currently selling enterprise software indiscriminately. But there will come a point where earnings, not speculation, become the benchmark. When that shift happens, the "winners" will be the ones who already own the data and the workflow” - Daniel Reaper

Enterprise software as a group is down ~19% from October peaks, yet fundamentals tell a very different story:

ServiceNow:

ServiceNow’s net revenue retention rate remains above 100%, indicating strong customer expansion and retention.

~20% EPS growth expected

Trading at its cheapest forward P/E ever (~28x)

The stock is trading 63.5% below analysts price targets,

Here is the breakdown of what analysts are saying:

4.64/5 analyst rating.

6 strong buys, 34 buys, 3 holds and 1 sell.

Salesforce:

Low-to-mid-teens EPS growth

FY P/E ~17x

FY2 PEG ~1x

Here is the breakdown of what analysts are saying:

4.36/5 analyst rating.

8 strong buys, 36 buys, 13 holds and 1 strong sell.

The verdict: the market is siding with that 1 analyst, instead of the overwhelming bullish majority.