In The Press: Ausbiz TV - The Battery Boom Investors Can’t Ignore

Daniel Reaper, Portfolio Manager, joined Ausbiz TV to discuss the global shift to renewables, the explosive structural growth in battery demand driven by EVs and grid storage, and why CATL, with its scale, vertical integration, low defect rates, and emerging sodium-ion technology, is well-positioned to benefit from the energy transition over the next decade.

Watch Video: The battery boom investors can’t ignore

The Green Transition

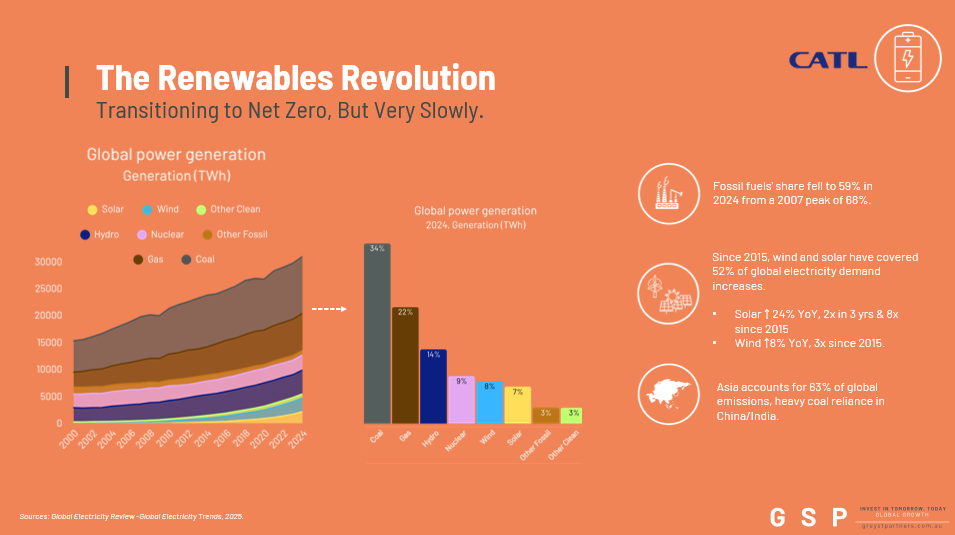

The world is in the midst of a renewable energy revolution, but it’s far from complete. Global power generation exceeded 30,000 terawatt-hours in 2024, yet fossil fuels still account for 59% of the mix, down from a peak of 68% in 2007. Wind and solar have grown rapidly: solar output has increased eightfold since 2015, and wind generation has tripled. Cost declines, particularly in solar, have accelerated adoption, but significant hurdles remain. Asia alone accounts for 63% of global emissions, with China and India heavily reliant on coal, while regions like Africa and Latin America generate only 3–4% of electricity from clean sources. Transitioning the global energy system requires new grids, transmission infrastructure, and decades of investment.

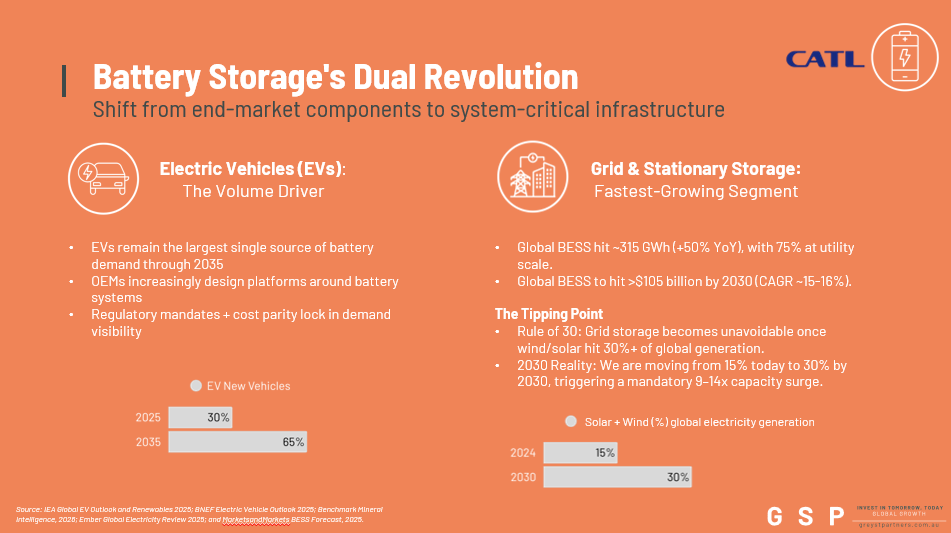

Despite these challenges, the shift to renewables is clear. Wind and solar currently supply about 15% of global electricity, but by 2030, renewables are expected to provide roughly 46%, with wind and solar contributing ~30% of total generation. However, their intermittent nature means energy storage is no longer optional, it is mandatory. Once renewable penetration exceeds 30–40%, grid-scale battery storage becomes essential to maintain reliability, manage peaks, and firm supply.

Battery Storage Demand and Why?

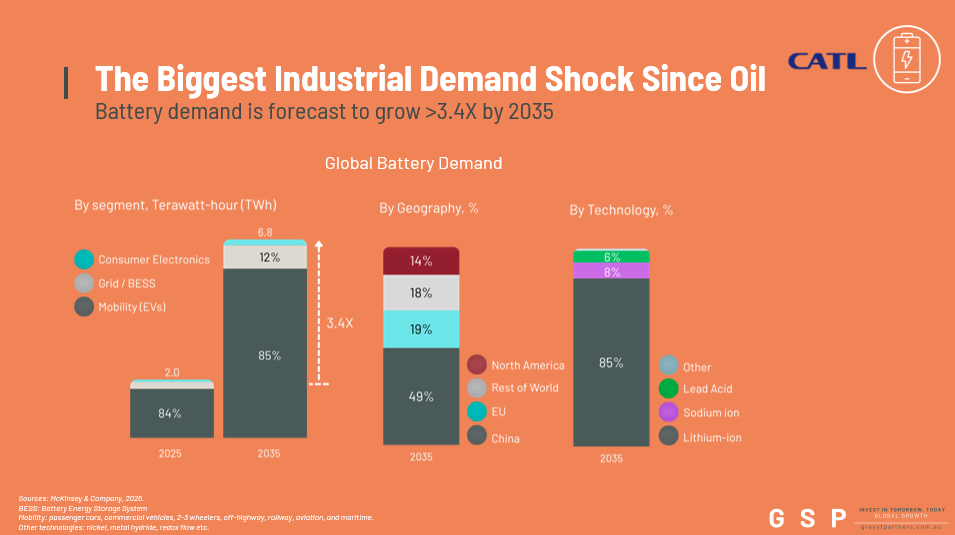

Battery demand is now structural and accelerating rapidly, much like semiconductors during the post-COVID electronics boom. Global battery demand is expected to grow from 2 terawatt-hours in 2025 to nearly 7 by 2035, a 3.5x increase. EV adoption is the largest driver: electric vehicles accounted for 25–30% of new car sales in 2025 and are expected to reach 60–65% by 2035. Batteries are replacing internal combustion engines at scale, with regulatory mandates and cost parity locking in demand.

Grid-scale energy storage is the second major growth engine. Global Battery Energy Storage System (BESS) installations reached over 315 GWh in 2025, up ~50% year-on-year, with utility-scale projects dominating ~75% of that growth. The IEA forecasts installed capacity to rise 9–14× by 2030, as storage becomes essential to manage variable renewable output and ensure grid stability. Consumer electronics remain a smaller but still meaningful portion of overall demand, adding to the structural growth profile.

The China Play - CATL

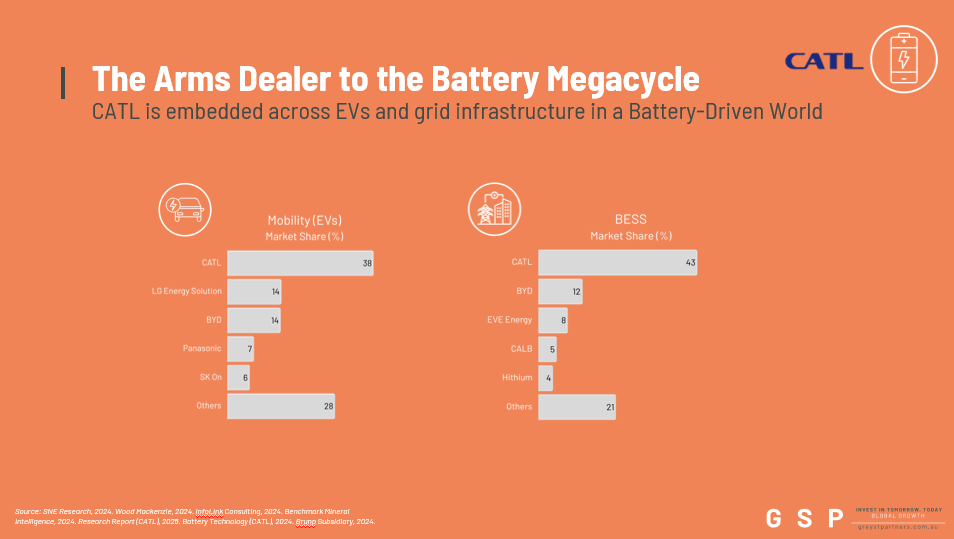

At the forefront of this boom is Contemporary Amperex Technology (CATL), the undisputed global battery leader. CATL powers 38% of EVs and 43% of grid-scale energy storage worldwide. Its investment appeal lies in extreme scale, multi-chemistry technology, and vertical integration—a “closed-loop” ecosystem that competitors cannot easily replicate.

CATL’s quality advantage is unmatched. Using AI-driven “Super Lines” with over 7,000 checkpoints, the company achieves defect rates in parts-per-billion (PPB), compared with parts-per-million (PPM) for peers. For massive grid projects, this precision makes CATL one of the only suppliers deemed “bankable” by insurance and utility companies.

Its grid storage technology is a game-changer. The TENER system guarantees zero degradation for five years, radically improving returns for energy investors and setting a new standard for utility-scale storage.

CATL’s vertical integration spans the battery value chain—from mines to recycling plants—allowing them to recover nearly all lithium, cobalt, and nickel from old batteries. This insulates margins from commodity price swings and ensures reliable supply.

Finally, CATL is technology-agnostic and future-ready. It leads in emerging chemistries, including sodium-ion batteries that operate in -40°C conditions—unlocking cold-climate markets. High-density condensed batteries are even paving the way for electric aviation. Combined with a global manufacturing footprint in Europe, CATL has minimized geopolitical risk while locking in long-term contracts with BMW, Mercedes, VW, and Stellantis.

In a world where battery demand is set to triple, CATL doesn’t need to win market share—they grow simply by standing still. With scale, technology, quality, and structural tailwinds on their side, CATL exemplifies the intersection of the green energy transition and smart long-term investing.