December Update

December marked a fitting close to a year defined by sharp swings, policy uncertainty, and ultimately mixed equity returns. While markets were mixed in the final month of 2025, the broader takeaway remains clear: global equities delivered gains, volatility rewarded patience, and monetary policy easing is now well advanced.

A Year In Review

The key lesson from 2025 was clear: sharp drawdowns remain a normal feature of equity markets, even within longer-term uptrends.

In November, Daniel Reaper spoke on Ausbiz TV (In the Press: Ausbiz - The Most Hated Rally Ever) talking about a year-end rally likely due to a number of factors and this thesis was correct. However, as s 2025 drew to a close, equity markets finished at or near record highs, yet headline index strength masked significant dispersion beneath the surface. Returns were driven by sector rotation and thematic exposure rather than broad market participation. US software and technology stocks came under notable pressure late in the year amid concerns that AI optimism had run ahead of near-term fundamentals, leaving US software the worst-performing industry relative to its 52-week highs. We view this scepticism as cyclical rather than structural and expect confidence to return as enterprise AI adoption delivers measurable productivity gains and supports a re-rating of high-quality platforms.

Market stress peaked in late March and early April as tariff concerns and trade policy uncertainty triggered a sharp sell-off. Volatility surged, with the VIX briefly spiking above 50, and several of the year’s best and worst trading days occurred within the same week.

April alone saw multiple daily moves of more than ±5%, followed by a powerful rebound that made May the strongest month of the year. November proved to be another difficult month for global growth equities as valuations across US Tech gets put under a microscope.

Looking ahead to 2026, we remain optimistic, particularly across several core holdings and long-term thematics that experienced material dislocations late last year. Despite the intensity of the AI narrative, only around 10% of US enterprises are currently using AI to produce a commercial good or service, underscoring how early we remain in the adoption cycle. As real-world use cases scale, we believe enterprise software—especially platforms enabled by agentic AI—is well positioned for a meaningful re-rating as fundamentals reassert themselves.

Global Markets Finish Stronger Than the U.S.

Equity markets diverged in December, with international equities once again leading. Emerging markets and developed ex-US equities rose approximately 3%, while the S&P 500 finished the month essentially flat. Small caps underperformed, with the Russell 2000 down -0.6%, reflecting ongoing sensitivity to higher long-term rates and tighter financial conditions.

Despite the muted December result, the S&P 500 closed 2025 up ~16–18%, a strong outcome that masks one of the most volatile calendar years since the pandemic era.

Economic Backdrop: Inflation Resumes, Labour Market Softens

December brought the first full inflation readings since September, following disruptions caused by the US federal government shutdown:

Headline inflation fell to 2.68% YoY, with core inflation at 2.69%

Unemployment ticked up to 4.6%, while payroll growth remained positive

Manufacturing activity remained in contraction, while services stayed expansionary

The Federal Reserve delivered another 25bp rate cut in December, taking the fed funds target range to 3.50–3.75%. Markets now see just a 16% probability of a further cut at the January 2026 meeting, suggesting the easing cycle is approaching a pause.

Looking Ahead Into 2026

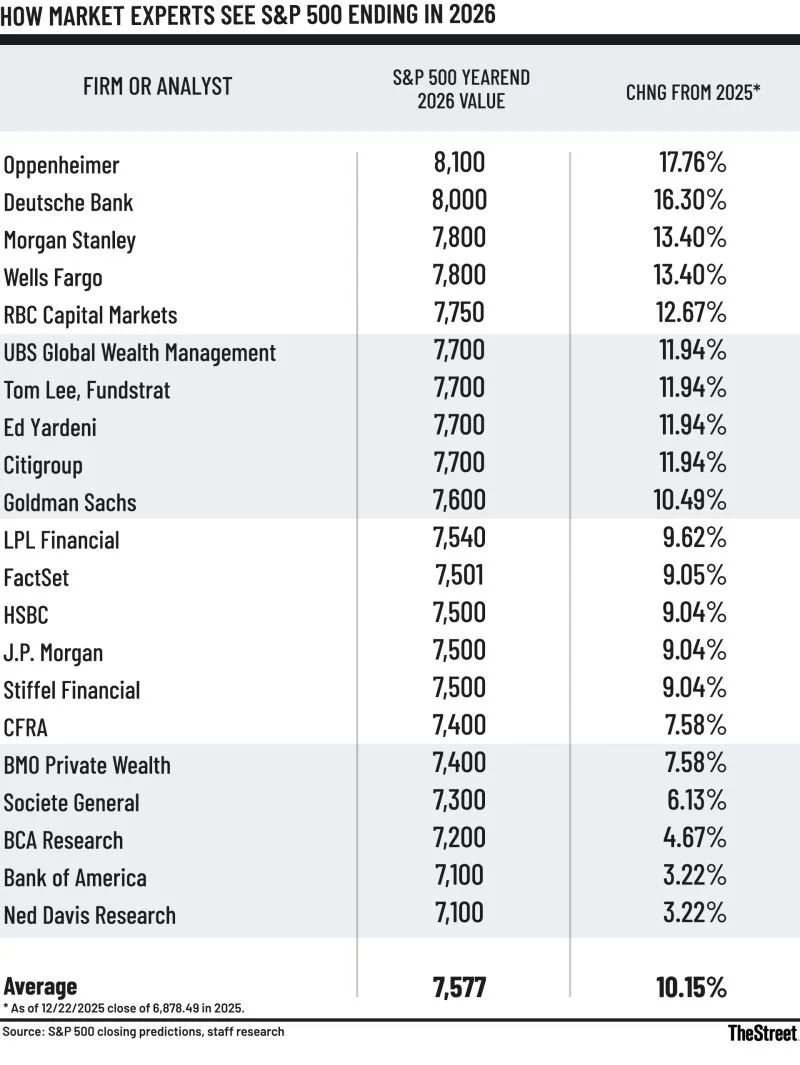

21 strategists & 21 bullish forecasts. Major sell-side firms are broadly optimistic for 2026, forecasting an average S&P 500 target of approximately 7,550–7,600. This bullishness is driven by double-digit earnings growth (forecasted at 12–15%) and an "AI supercycle." However, analysts warn that extreme market concentration and high valuations could trigger a correction if yields spike. However, the index could exceed 8,000 if the Federal Reserve is more aggressive with rate cuts. Consensus estimates for 2026 EPS sit at roughly $305–$306, a 12.5% increase from 2025. Analysts expect the "Mag 7" to drive nearly 46% of total index earnings growth as AI investments begin to monetize.

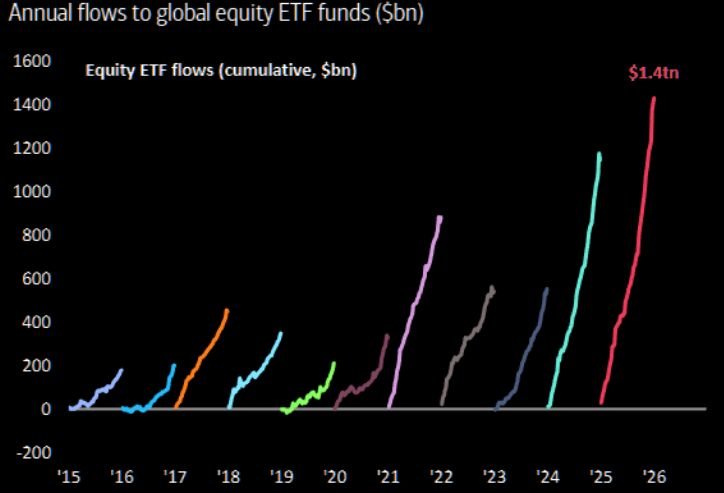

The Year of the ETF: 2025

Global Equity ETFs saw annual inflows of $1.4 Trillion, the largest in history. The annualized flow into equity ETFs is now nearly triple the pre-2021 average and it has now become a liquidity tsunami that has created a permanent bid for mega-cap equities (S&P 500/Nasdaq), making "dip-buying" almost mechanical. Interestingly, Active ETFs accounted for a record ~30% of those 2025 flows, a massive jump from previous years.

Source: Barchart, BofA, The Market Ear

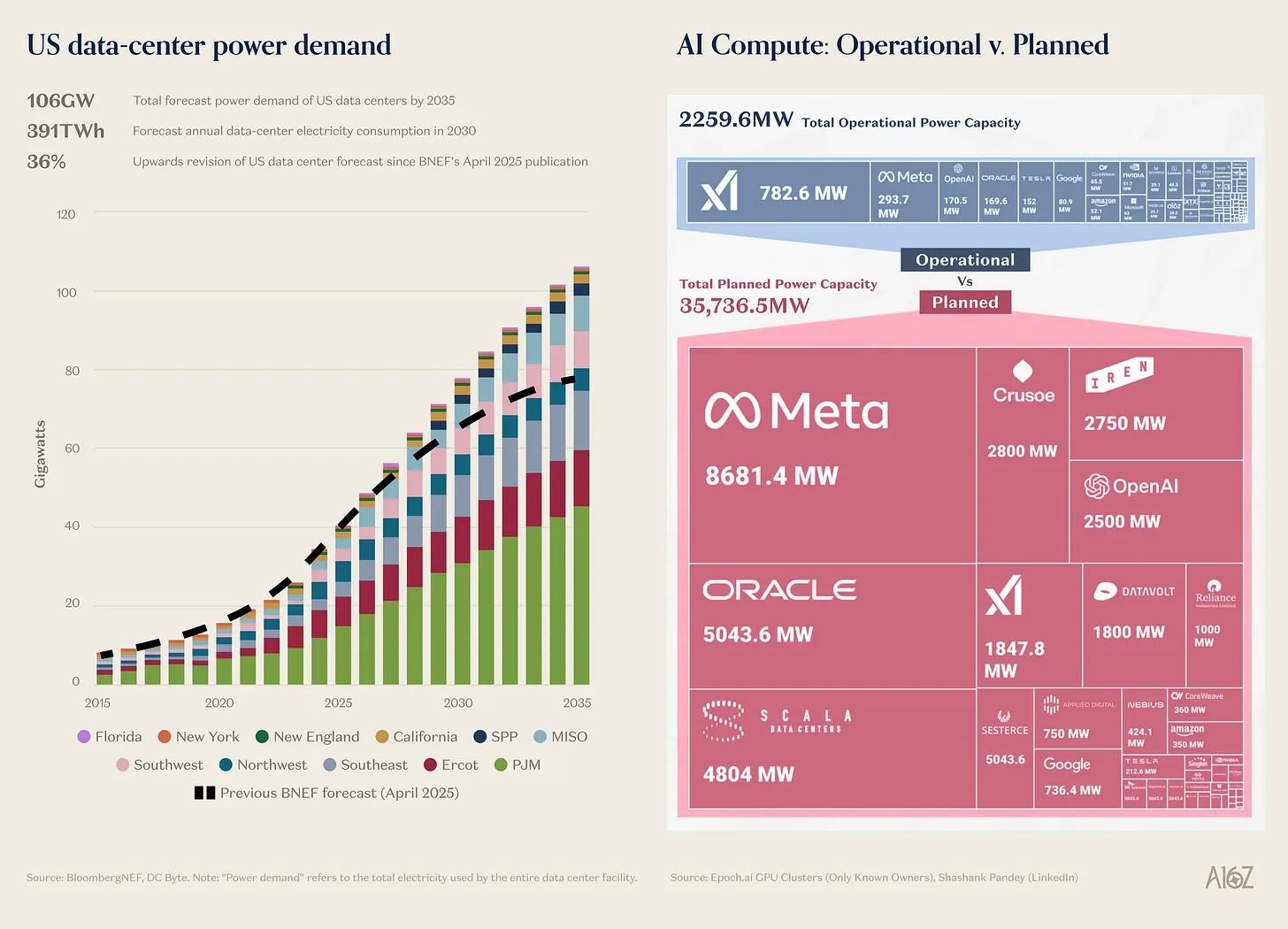

Thematic Review: Data Centers

US data-centre power demand is surging as AI scales, with planned capacity vastly exceeding what’s live. Data-center power demand hits 106 gigawatts (GW) by 2035 in BloombergNEF’s newest forecast – a 36% jump from the previous outlook, published just seven months ago. Efficiency gains are increasing total compute usage (Jevons Paradox). AI shifts constraints from labour to infrastructure, power, cooling, chips, and capital, driving sustained demand for cloud compute, semiconductors, and energy systems.