January Update

10th February, 2026

January was another challenging month for global managers, with US software weakness and sharp swings in AUD/USD volatility testing portfolios. By month-end, about one-third of S&P 500 companies had reported, and the index remains resilient despite some metrics lagging historical averages. US macro was “on hold, not done”: the Fed kept rates steady, highlighted solid growth, and signalled no rush to cut while inflation remains above target. Markets are navigating a mix of robust fundamentals, sector rotation, and elevated expectations.

Wild Currency Swings

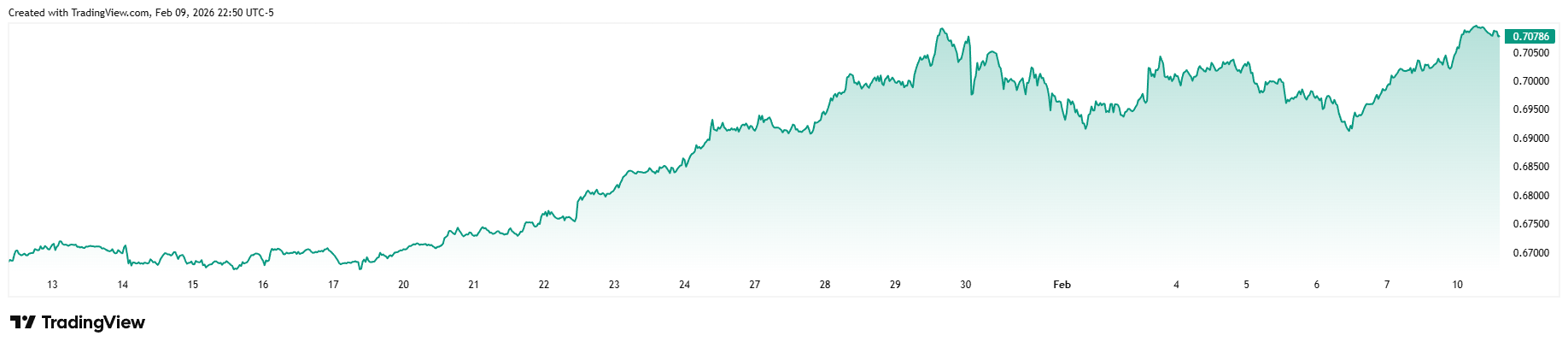

AUD/USD chopped around early in the month (0.6676–0.6737 range through mid-January), then exploded higher from January 20, jumping from 0.6732 to 0.7049 by January 29, a blistering ~5%. The final trading week alone saw intraday and close-to-close volatility that felt "ridiculous," with daily ranges exceeding 1–2% amid thin liquidity, RBA hike pricing, and US macro noise. Average monthly rate landed near 0.6786, but the ~3.7 cent peak-to-trough swing (over 5.5% relative) marked one of the pair's most volatile Januarys in years. RBA vs Fed divergence takes hold: Australia's stronger-than-expected labour data and sticky inflation flipped markets to price ~50bps of RBA hikes in 2026, while the Fed held steady post-2025 cuts and dialled back easing bets, classic policy spread fueling AUD strength. We have confidence that this trend will continue.

US Software Pressure

Global Growth managers were not insulated from weakness in US software. The iShares Expanded Tech-Software Sector ETF (IGV), which tracks the US software subsector, came under notable pressure in January 2026 amid sector rotation and renewed AI-related reassessments. IGV declined roughly 3–5% over the month, underperforming the modestly higher S&P 500. This continues a trend where software has lagged mega-cap hardware and semiconductors, reflecting a shift away from 2025’s narrow cohort of AI infrastructure leaders toward cyclicals and smaller names across tech.

For further insight, Daniel Reaper, Portfolio Manager, provides a candid take on some of these moves, highlighting that AI acts as an enabler for large-scale enterprise software, rather than a disruptive force.

Read: Quick Bites: Is Enterprise Software Dead?

US earnings snapshot – January reporters

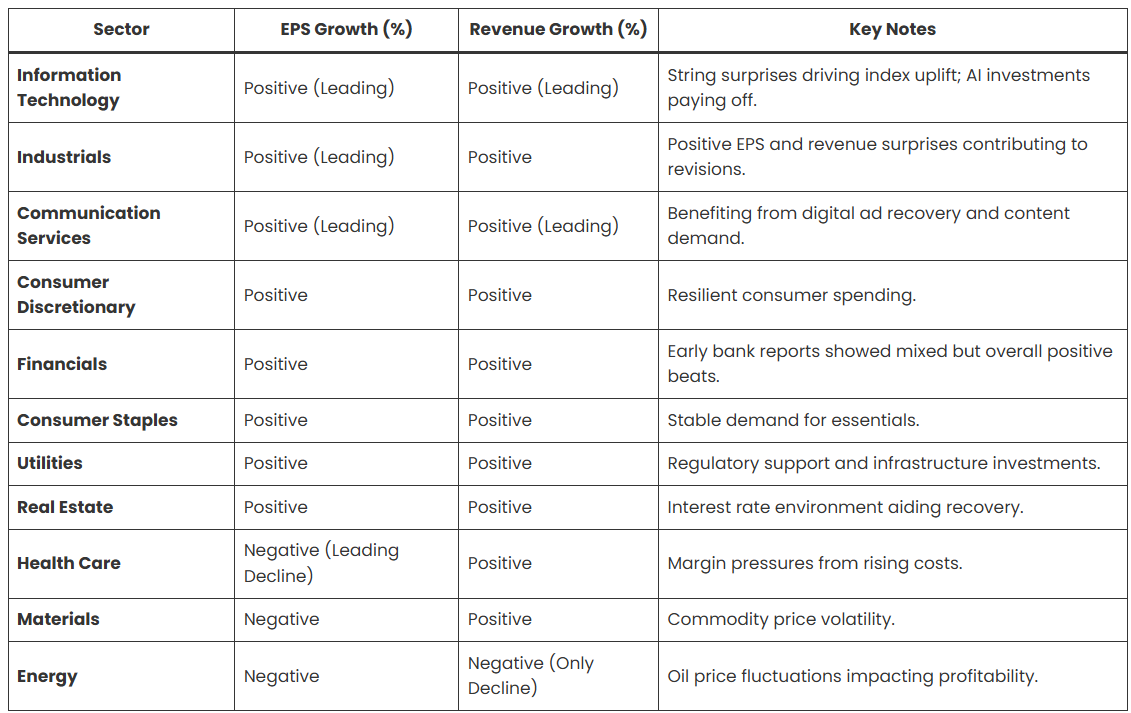

By January 30, 2026, around one-third of the S&P 500 (roughly 165 companies) had reported Q4 2025 earnings, and several clear themes have emerged.

Earnings growth is running ahead of expectations. Blended Q4 S&P 500 EPS growth has lifted to roughly 11–12% year-on-year as results have come in, comfortably above the ~8% growth expected at the end of the quarter. Around two-thirds to nearly four-fifths of reporting companies have beaten EPS estimates, pointing to resilient corporate profitability despite tighter financial conditions.

Revenue trends remain solid, if unspectacular. Approximately the mid-60% of companies have beaten revenue expectations, slightly below five- and ten-year averages but aggregate sales growth is still tracking in the high single digits. Importantly, this extends a run of more than 20 consecutive quarters of positive top-line growth for the index.

Sector performance has been uneven. Energy and materials have emerged as early leaders, delivering both strong earnings momentum and share-price performance. In contrast, information technology has underperformed on a price basis despite robust profit growth, reflecting crowded positioning and elevated expectations rather than fundamental weakness.

Mega-cap technology remains the key swing factor. Late January attention has centred on results from Microsoft, Apple, Meta and Tesla, with consensus expecting mid-20% earnings growth from large-cap tech versus low single-digit growth for the rest of the index. Investor focus remains intense on AI-related capital expenditure, returns on investment, and the pace of monetisation.

Overall, Q4 earnings are coming in better than feared, with signs that market leadership is beginning to broaden beyond last year’s narrow, mega-cap led advance.

Looking ahead, earnings expectations remain constructive. Q1 2026 EPS is forecast to grow 11.7% year-on-year, accelerating to 14.9% in Q2. Full-year 2026 earnings are projected to rise 14.3–14.9%, up from 12.4% in 2025. Valuations reflect this optimism, with the forward 12-month P/E at 22.2x—above five-year (20.0x) and ten-year (18.8x) averages, leaving markets increasingly sensitive to any earnings or macro disappointment.

Source: Roancp

US Rates On Hold

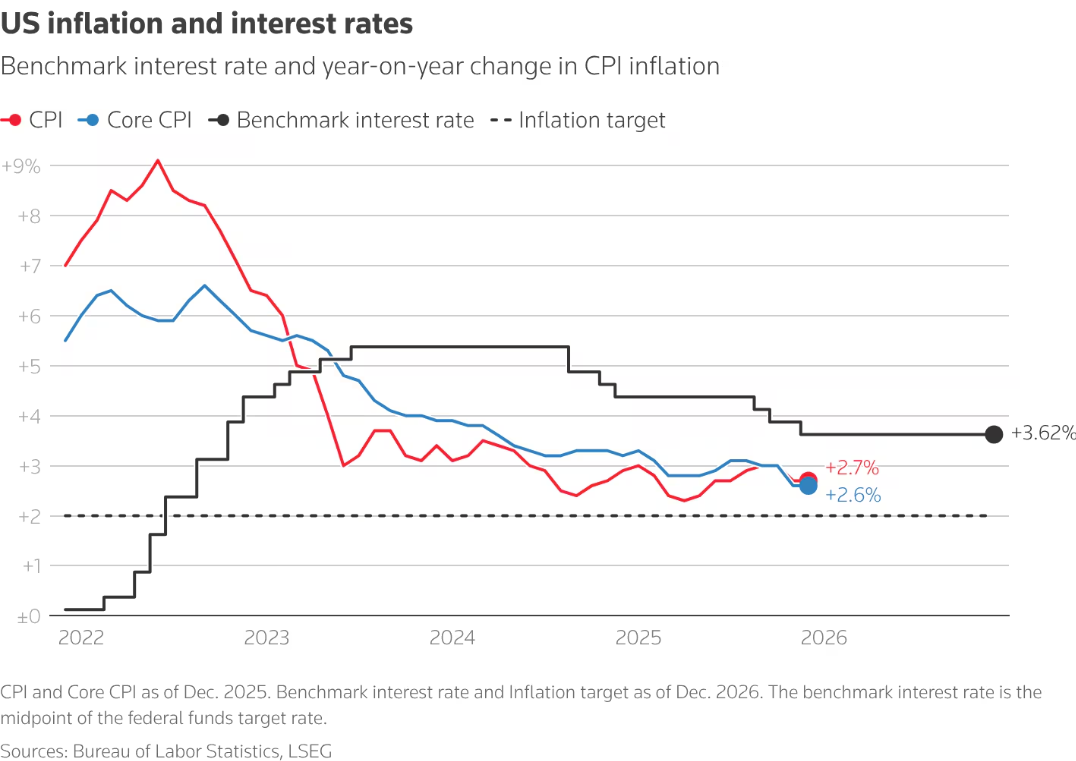

The Fed held rates steady in January following last year’s cuts, signalling that policy is appropriately calibrated for an economy still growing at a solid pace, with a labour market that’s cooling but far from weak. Officials reinforced a firmly data-dependent stance, subtly pushing back on expectations for rapid or early-2026 easing and framing current policy as near-neutral rather than overtly restrictive. For markets, this marked a shift from “aggressive cuts ahead” to a slower, more measured easing path helping cap longer-dated yields while keeping front-end volatility elevated.

Inflation data continues to support this cautious posture. The final CPI print for 2025 showed headline inflation at ~2.7% year-on-year and core inflation near 2.6%—well below cycle highs, but still above the Fed’s 2% target. Monthly prints in the 0.2–0.3% range underline the familiar divergence: goods inflation remains flat to negative, while services, particularly shelter, food, and healthcare, remain sticky.

Meanwhile, the labour market is cooling gradually rather than cracking. Payroll growth has moderated from post-pandemic extremes, but job creation remains positive and unemployment low, offering little evidence of the deterioration that would compel the Fed to ease policy in the near term.